This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.

Anyone reading this probably already knows that electric-vehicle (EV) maker Tesla (NASDAQ: TSLA) recently reported solid third-quarter results. Profits were better than expected, and the company indicated its production would continue growing. Investors celebrated by sending the stock 22% higher on Thursday.

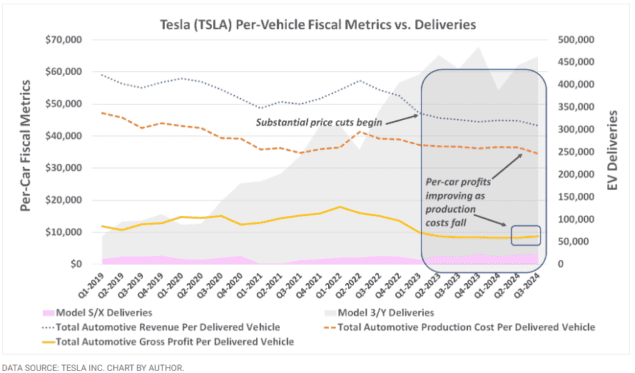

The numbers alone, however, don't tell the whole story. An image is required to fully appreciate the fact that Tesla may have just turned the profit corner.

Even better than it seems

For the three months ended in September, the electric vehicle company turned $25.2 billion of revenue into earnings that worked out to $0.72 per share. Although the top line fell short of estimates, it was still up 8% from a year ago. Meanwhile, the bottom line topped estimates of about $0.60 per share, improving slightly on earnings reported in Q3 of 2023. Meanwhile, although total deliveries of 462,890 vehicles were just a tad shy of the expected 463,897, the figure was still markedly better than last year's third-quarter count of 435,059.

These numbers alone, however, lack important context for investors.

In this case, the missing context is the evolution of Tesla's results since early 2022 — when production and deliveries of its lower-cost Model 3 cars began ramping up in earnest — followed by substantial price cuts introduced early last year. You may recall that both have increasingly pinched the company's bottom line, as production costs haven't fallen as much as its cars' non-negotiable sticker prices have.

That may no longer be the case, though.

As the graphic below illustrates, thanks to a significant and deliberate reduction in production costs to an average of $34,544 per car in Q3, Tesla's per-vehicle gross profit improved from $8,269 in the second quarter to last quarter's $8,698. It's the first sequential growth of this measure since the first quarter of 2022. It's also the highest since Q2 of 2023, when Tesla was in the midst of reconfiguring its production floors. Making the feat even more significant is the fact that the reduction in production costs was bigger than Tesla's price cuts for its cars.

There's one detail worth mentioning about the image above. That is, although neither significant nor significantly different during Q3, the per-vehicle revenue in question includes regulatory credits and leasing revenue.

Regardless, Tesla's automobile business does appear to be turning an important profitability corner. In light of this new trajectory, investors can entertain hopes for income growth as it seeks to begin production of an even lower-priced car. And, Tesla itself can justify making more and bigger investments in greater production capacity.

The turning point investors have been waiting for

And that's the big takeaway here. Although last year was an expensive one without a great deal of net payoff, we can now see the sacrifice was worth it. Output is growing again. Only this time, profits are growing with it.

One good quarter isn't a trend, of course. But all trends do start with that first good quarter.

More to the point, this is great news for current and prospective shareholders. Given that Chief Executive Officer Musk expects Tesla's unit sales to grow between 20% and 30% next year — growth that will obviously require more production — the fact that profitability is scaling up along with output is exactly what patient shareholders have been waiting to see.

This article was originally published on Fool.com. All figures quoted in US dollars unless otherwise stated.