The Tesla Inc (NASDAQ: TSLA) share price is taking a page from SpaceX's book and rocketing higher in after-hours trade.

Shares in the electric vehicle (EV) maker are up 12% to $239.33 after the company released its third-quarter earnings. The boost in sentiment follows an 18% weakening in Tesla shares over the three weeks leading into today's result.

Despite the boost, the Tesla share price is still 13% below its 52-week high of $271 per share.

Musk delivers better margins

Tesla surpassed expectations on multiple fronts in the third quarter. The most prominent beat is the carmaker's adjusted earnings per share of 72 US cents (up 9% year-on-year) versus the expected 58 US cents per share.

You might immediately think the earnings beat is a product of better-than-expected revenue, but that's not the case. Tesla slightly missed analyst estimates with quarterly total revenue of US$25.18 billion (up 8% year-on-year) compared to the expected US$25.37 billion.

Instead, the earnings surprise can be attributed to improved margins.

According to the Q3 presentation, Tesla's cost of goods sold per vehicle dropped to a record low of ~US$35,100. Furthermore, expansion in energy generation and storage, as well as services revenue, lifted the company's margins in the third quarter.

As highlighted in Brian Stoffel's post above, Tesla's energy segment achieved its highest-ever gross margin of 30.5%. Alongside sequential improvements in auto and services gross margins, the performance resulted in an overall gross margin of 19.8% (a 1.95% increase year-on-year).

What else is driving the Tesla share price?

As always, the quarterly conference call was full of bold ambitions. The quarterly result is not too shabby, but usually, the focus is on the road ahead.

Notable remarks on the company's near-term future in this morning's call included:

- FY25 Automotive revenue growth guidance of 25% versus 16% expected

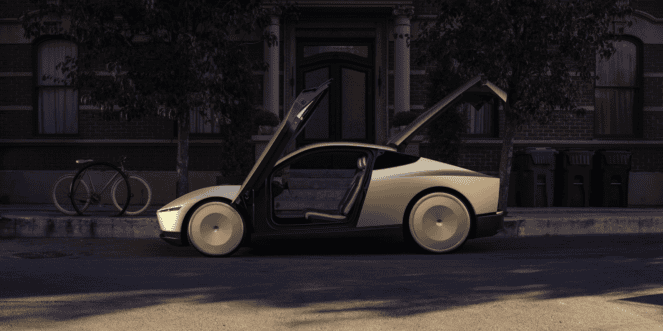

- Targeting approximately 2 million Cybercab (pictured below) units per year

- Plans to launch a ride-hailing app in Texas and California in 2025

- Expecting full self-driving to be safer than a human by Q2/Q3 FY25

The after-hours Tesla share price implies a market capitalisation of US$764 billion.