It's common for the ASX stock market to experience ups and downs. Every day, different buyers and sellers trade amid various economic and political events.

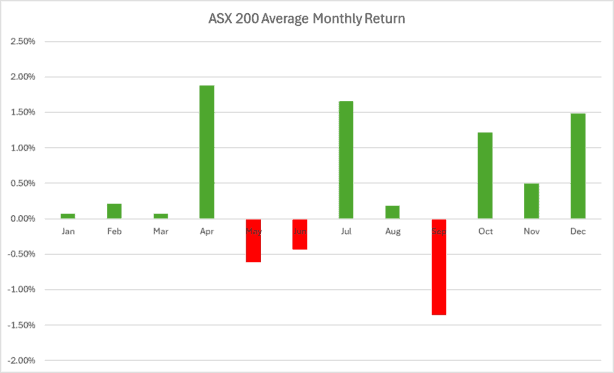

However, over time, some months have built up a reputation for positive returns — think the 'Santa rally' in December. S & P Market Intelligence data shows that December has historically been one of the best-performing months for the S&P/ASX 200 Index (ASX: XJO) since 2000, with an average monthly return of 1.49%.

The positive long-term returns of the market include both the good months and the bad months, so it's probably best to stick with a long-term investment mindset – I wouldn't sell anything based on what month it is.

However, if share prices do fall, then it could be an opportunity to invest at a cheaper price.

There's one month that sticks out in the data as the best time to buy.

September woes

According to S & P Market Intelligence, September has been the worst month (by far) over the last 24 years, with an average monthly return of negative 1.35%.

The other two negative months have been May and June, with average negative returns of 0.62% and 0.44% for the ASX 200 stock market, respectively. The chart below shows the average movements for each month over the past 24 years.

Source: S & P Market Intelligence

Coincidence or not, the ASX 200 is currently down by 1.4% in September 2024 to date, which is almost exactly what the average decline of the last 24 years has been.

I wouldn't expect the decline to be 1.4% by the end of the month, though.

However, I do think we can take advantage of these slightly lower prices by buying at a cheaper price.

Households that regularly invest can utilise a dollar cost-averaging strategy. Warren Buffett once explained why it's a good thing for accumulators that share prices fall:

If you expect to be a net saver during the next five years, should you hope for a higher or lower stock market during that period?

Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall.

Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.

Where I'd invest in ASX stocks

There are plenty of attractive ASX ETFs that are priced lower and could be good investments.

Investors wanting exposure to the cheaper ASX 200 may want to consider the iShares Core S&P/ASX 200 ETF (ASX: IOZ) or one of the similar ASX-focused ETFs.

Some of my favourite ETFs — including the Vanguard MSCI Index International Shares ETF (ASX: VGS), Betashares Global Quality Leaders ETF (ASX: QLTY), and VanEck MSCI International Quality ETF (ASX: QUAL) — are also lower after the volatility.

Individual ASX 200 shares could also be good investments. The Motley Fool website is all about finding good ASX stocks to invest in.