Lendlease Group (ASX: LLC) shares are running in the opposite direction to the rest of the market today.

Shares in the embattled real estate investment group are down 1.8% to $5.59 in morning trade. Meanwhile, the S&P/ASX 200 Index (ASX: XJO) is ratcheting up 1.1% after Wall Street enjoyed another record high last night.

Only 27 of the top 200 companies included in the benchmark index are in the red today, and Lendlease is one of them. The nonconforming move follows an update from the Australian Competition and Consumer Commission (ACCC) this morning, throwing a cat among the pigeons at Lendlease.

Competition concerns

On 18 December 2023, Lendlease struck a deal with Stockland Corporation Ltd (ASX: SGP) and Thailand property company Supalai to sell 12 Australian masterplanned community projects for $1.3 billion.

The asset sale is subject to regulatory approvals, which might be a sticking point.

Today, the ACCC — Australia's corporate watchdog — has raised preliminary concerns about the proposed sale. Specifically, the regulator is wary of a lack of competition in masterplanned community projects on a Lendlease exit.

ACCC commissioner Liza Carver detailed the competitive dynamics at play, stating:

We are concerned that the proposed acquisition would remove one of Stockland's closest and largest competitors in the supply of residential masterplanned community housing lots in four regions — the Illawarra, North West Perth, Ipswich, and Moreton Bay.

The ACCC is concerned that the proposed acquisition may increase Stockland's incentive to raise the price, delay the supply, or reduce the quality of housing lots in these regions, to the detriment of prospective homeowners.

Furthermore, Carver explained that the regulator was concerned that other developers may not compete sufficiently with Stockland following Lendlease's sale.

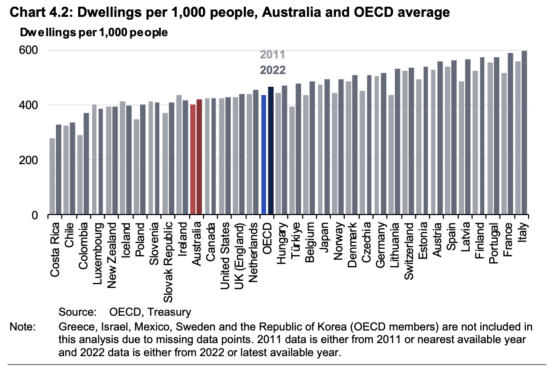

Such concerns are possibly magnified by Australia's ongoing housing crisis. The 2024-2025 Federal Government Budget highlights Australia's below-OECD average housing supply of 420 per 1,000 people, as shown above.

The ACCC has yet to decide whether to allow, block, or amend the deal.

Are Lendlease shares walking a tightrope?

A snapshot of the Lendlease balance sheet on 31 December 2023 shows a business sitting in $3.74 billion of net debt.

The real estate group posted $331 million in negative cash from operations for the 2023 calendar year. If Lendlease is in a large amount of debt and not producing cash from its operations, how will it cover its interest payments?

Part of the push to liquidate some of the group's assets might be due to the questionable financial position. So, if Lendlease was betting on a $1.3 billion payday, a hold-up by the ACCC might pose a financial threat to the company.

Fortunately for Lendlease shares, the group has other asset sales on the go. After a 49% fall in the share price over three years, the last thing a Lendlease investor would want is to raise capital now.