Who doesn't enjoy a boost to their income? Dividends are a big reason why many choose to invest. That's why passive income chasers pay attention when an ASX 200 stock lifts its dividend payout ratio — bigger payments could be ahead.

Yesterday, a $17 billion Australian company highlighted an increase in its payout ratio. The determination, shared in an investor briefing, follows an extended period of debt reduction by one of the country's steadfast energy providers: Origin Energy Ltd (ASX: ORG).

So, what does it mean for the back pockets of its shareholders?

Dividends to take a bigger share of earnings pie

Operating a utility company can be extremely capital-intensive. Just take a look at the gross margins of Origin and AGL Energy Limited (ASX: AGL). We're talking respective margins of 20.8% and 28% before removing operating expenses.

Nonetheless, utility companies can still offer a fountain of dividends. Nearly every household's needs-based nature of electricity and gas provides a reliable income. For Origin Energy, it means investors can enjoy a dividend yield of 4.8% from this ASX 200 stock.

But what about the increased dividend payout ratio?

As per the investor briefing, Origin Energy will target a payout ratio of at least 50% of free cash flow.

This is slightly different from what a standard dividend payout ratio reflects. Typically, this figure is based on the percentage of net income or net profit after tax (NPAT) paid as a dividend. Free cash flow differs from NPAT, representing the company's operating cash flow minus its capital expenditures.

Previously, Origin Energy's targeted payout ratio was set between 30% and 50%.

Does it mean more dividends from this ASX 200 stock?

What really matters to most is whether it means more dollars hitting the account. Unfortunately, the answer to this is not as straightforward.

While Origin's payout ratio now has a higher minimum, future free cash flows (FCF) will be the deciding factor.

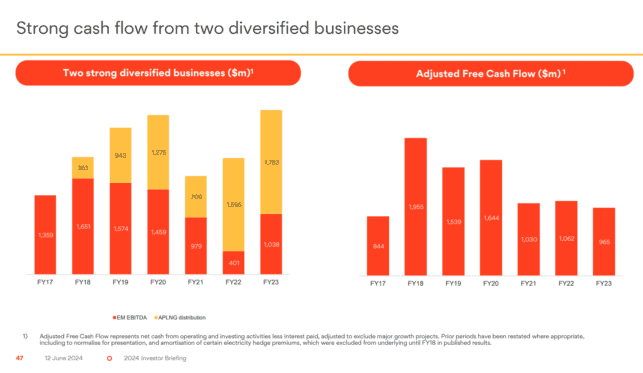

As shown on the right-hand side of the image above, the energy company's adjusted FCF have stagnated across the last three financial years. If Origin's free cash flow were to fall in FY24, it could mean a bigger slice of a smaller pie.

The share price of this ASX 200 stock is up 17.8% year-to-date.