Whether by preference or circumstance, investors are often drawn to the big dogs of the ASX. The sheer size of companies in the S&P/ASX 20 Index (ASX: XTL) offers a level of security and dependability that is seldom found elsewhere — making it a popular fishing hole for top dividend stocks.

Some of the biggest dividend payers are housed within the 20 largest companies by market capitalisation. We're talking about the likes of BHP Group Ltd (ASX: BHP), Westpac Banking Corp (ASX: WBC), and Telstra Group Ltd (ASX: TLS).

There are plenty of solid options. However, if I wanted to invest a decent sum of money in only one, I know exactly which company I'd select.

Process of elimination

I like to keep it simple when searching for a source of passive flows. The criteria I'll first inspect are the current dividend yield and net income margin.

The company's net margin is key. The way I see it, the more money the business is making, the more it can afford to pay me as a shareholder. Low margins require management to run a tight ship; if choppy waters were to hit, those dividends might be the first to go overboard.

As such, Woolworths Group Ltd (ASX: WOW) and QBE Insurance Group Ltd (ASX: QBE) are scrapped due to their low margins.

Additionally, commodity-linked businesses are susceptible to years of unprofitable prices. I'm not interested in that level of unpredictability in dividend income, excluding companies like Woodside Energy Group Ltd (ASX: WDS) and Santos Ltd (ASX: STO).

The cherry on top of a dividend stock is a catalyst for growth.

Tailwinds for this top dividend stock

As I discussed in another article today, The Big Short star Steve Eisman believes infrastructure is poised for massive expansion over the next decade. I tend to agree. So, it stands to reason a business in this domain could grow its dividends over the coming years.

Despite its more modest dividend yield of 3.7%, I figure Macquarie Group Ltd (ASX: MQG) is the top dog for the job.

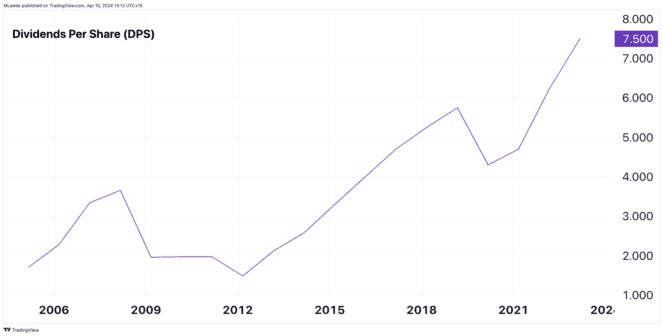

The investment bank has routinely posted net margins above 20%. Moreover, dividends per share have grown significantly in the last decade. In 2023, Macquarie delivered $7.50 in annual dividends, compared to $2.12 in 2013, as shown above.

Lastly, Macquarie is arguably at the epicentre of infrastructure development. Through its Macquarie Asset Management arm, the company already manages $882.5 billion in assets.

As more infrastructure is developed, Macquarie is well-placed to engage in public-private partnerships (PPPs) with governments to obtain the necessary funding.