Transurban Group (ASX: TCL) shares are steady at $13.20 on Thursday.

Transurban owns a portfolio of 22 toll roads in Australia and North America. Some names you may be familiar with are the CityLink, Cross City Tunnel, and the Eastern Distributor.

The toll road operator has been an interesting stock to watch over the past few years. Some big economic and demographic changes have occurred that have directly advantaged and disadvantaged the stock.

For example, COVID ushered in a new workplace era with plenty of people now working from home, and therefore no longer on the roads in peak hours.

But we've also seen good population growth, primarily due to migration rather than natural increase, and that means more road users.

And the company has navigated rising inflation better than most because a large percentage of its revenue is linked to the going CPI rate, and a further chunk benefits from fixed rates of toll increases.

Here's a chart showing how the Transurban share price has moved around over the past five years.

As you can see, the stock has moved in a pretty tight price band, demonstrating relative stability and resilience after recovering from the COVID market crash.

And what about dividends?

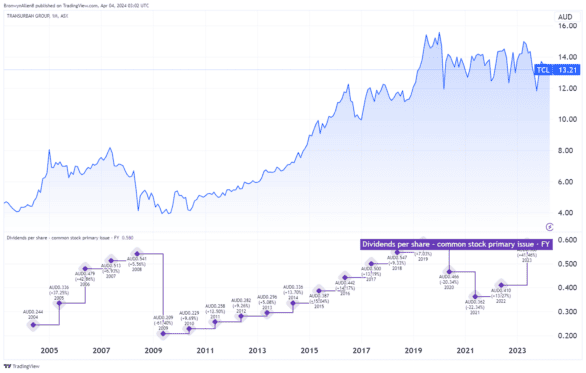

In short, pretty good growth and reliability here, as the chart below shows.

Transurban raised its dividend consistently for 10 years until COVID punched a hole in revenues in 2020.

Despite this, the company kept paying dividends throughout the pandemic.

In 2019, Transurban declared a 61-cent dividend for the full year.

It only got back to paying this sort of amount last year, declaring 61.5 cents would be paid per share.

What will the Transurban dividend be in 2024?

The consensus analyst forecast published on CommSec is for Transurban shares to pay 62.1 cents per share this year.

The analysts expect an increase to 65.4 cents in 2025 and 68.7 cents in 2026.

Let's see how that shakes out in dividend yield terms.

A $10,000 budget (minus a brokerage fee of $5) will buy you 757 Transurban shares at the current price.

Total spend = $9,992.40.

If we multiply 757 shares by 62.1 cents, we get a total annual dividend amount of $470.10. That's a dividend yield of 4.7%.

In 2025, the dividend payment is anticipated to be $495.10. That's a dividend yield of 4.95%.

In 2026, the dividend payment is tipped to be $520.05. That's a dividend yield of 5.2%.

What's next for Transurban shares?

Both Citi and Bell Potter think Transurban shares can rise in price from here.

And both brokers have exactly the same 12-month target price on the ASX share.

That price is $15.60, which implies a potential 18.2% upside for investors who buy Transurban shares today.