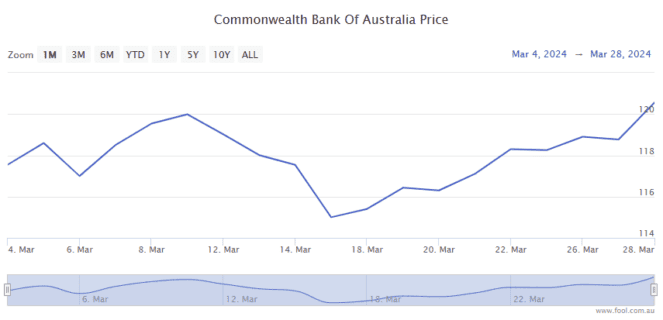

The Commonwealth Bank of Australia (ASX: CBA) share price had a month to remember in March.

Shares in the S&P/ASX 200 Index (ASX: XJO) bank stock closed out February trading for $116.41.

Despite numerous analysts labelling the bank as over-priced, trading at a significant premium to its peers, CBA finished March trading for $120.42 a share, notching a series of new record highs early in the month.

That strength saw the ASX 200 bank stock gain 3.4% over the month, handily outpacing the 2.6% gains posted by the benchmark index over this same period.

Australia's biggest bank also outperformed many of its rivals over the month.

The VanEck Vectors Australian Banks ETF (ASX: MVB) is exclusively invested in ASX bank stocks. And the exchange-traded fund (ETF) trailed CBA's performance, gaining 2.0% in March.

Eligible shareholders will also have received the boosted, fully franked interim CBA dividend of $2.15 a share on 28 March, the final trading day of the month. Though the stock traded ex-dividend in February, so this is unlikely to have had any impact on the CBA share price in March.

What's been happening with the CBA share price?

Among the tailwinds for CBA, and indeed every ASX bank stock, is the rising expectation of a soft landing for the Aussie economy with interest rate cuts on the horizon.

A stronger economy would bode well for CBA's books, ushering in higher lending with lower non-performing loan levels.

And March saw investors increasing their bets on interest rate cuts from the Reserve Bank of Australia (RBA) in 2024 amid signs inflation is coming under control.

A lower official cash rate could help boost the bank's bottom line, and the CBA share price, if the bank decides not to pass the full level of those cuts on to its borrowers.

With an eye on costs, March also saw CBA announce that its Western Australian subsidiary, Bankwest, will become a digital-only bank in 2024. Forty-five Bankwest branches will be closed by October 2024. Fifteen other regional Bankwest centres will be converted to CBA branches.

ASX 200 investors shrug off broker warning

The CBA share price had a strong run in March despite some bearish sentiment on the broader ASX 200 banking sector from analysts at Macquarie.

On 14 March, Macquarie downgraded National Australia Bank Ltd (ASX: NAB), Westpac Banking Corp (ASX: WBC) and ANZ Group Holdings Ltd (ASX: ANZ) to an underperform rating.

The broker already had CBA at an underperform rating with a price target of $95 a share. Or some 21% below the current CBA share price.

"Banks are trading at peak multiples without a clear fundamental reason," Macquarie analyst Victor German said at the time.

"We believe the economic and stock-specific settings that underpinned banks' outperformance during previous rate cut cycles are not evident," he added.

Time will tell.

But with CBA smashing into new all-time highs in March, I wouldn't be rushing to hit the sell button.