After two years of underperformance, ASX small-cap shares are ready to roar again.

Datt Capital chief investment officer Emanuel Datt reckons Australian small caps are even more attractive than their US counterparts.

"The inefficiencies and relative under-coverage of the Australian market create fertile ground for identifying overlooked gems and undervalued assets," he said.

"The Australian market is considerably cheaper than the US market on a relative basis. Valuation differentials between the two markets are quite apparent, with Australian equities trading at more attractive multiples compared to their US counterparts."

Not only are the local stocks cheaper, they have an excellent outlook, he added.

"Australian small caps present opportunities for growth, particularly in emerging industries like technology, healthcare, and renewable energy."

With this in mind, here are three top ASX shares I would be tempted to buy this month from small-cap land:

Top ASX shares to invest in mining without investing in mining

My first two picks have similar customers.

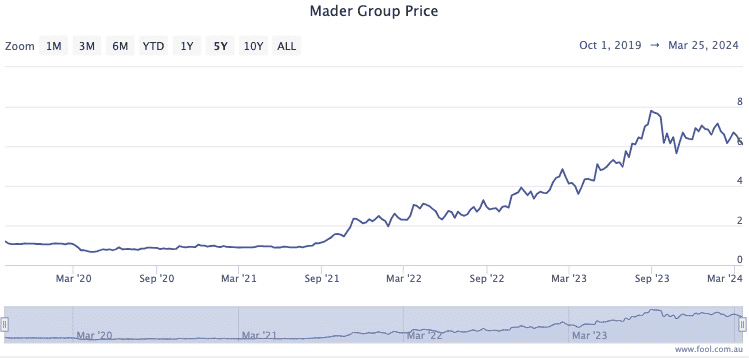

RPMGlobal Holdings Ltd (ASX: RUL) provides technology and related services, while Mader Group Ltd (ASX: MAD) is a maintenance contractor for mining companies.

They are both growth shares but a handy way to gain investment exposure to the cyclical resources industry.

With both western and Chinese economies set to pick up in the coming years after battling inflation and deflation in recent times, commodity prices could be on the way up.

And when minerals are in hot demand, mining businesses will be calling on contractors like RPMGlobal and Mader Group to ramp up their activities.

Both small caps have strong support in the professional investor community.

The team at Forager, in a memo to clients, forecast that RPMGlobal would keep growing its revenue and profits "for a long while yet".

"The company now has a $500 million market capitalisation and trading volumes in its shares have increased markedly over the past month, making it potentially appealing to a wider range of institutional investors."

Broking platform CMC Invest shows Moelis and Veritas Securities also rating RPMGlobal as a strong buy at the moment.

Mader Group shares are recommended as a buy by five out of six analysts.

Small-cap software maker taking on the world

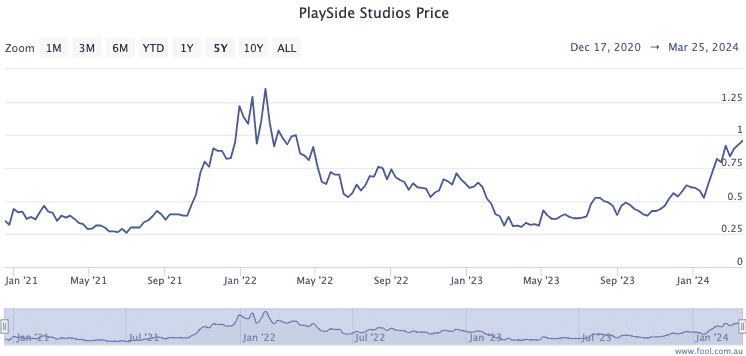

Playside Studios Ltd (ASX: PLY) shares are already going gangbusters.

It has rocketed 52% so far this year, and is close to tripling over the past 12 months.

Incredibly, more than one expert reckons there is more growth to come for the Melbourne video games maker.

The Cyan Fund has been a longtime supporter of Playside Studios.

"All parts of the business are performing well and the company is enjoying strong investor support as it looks to execute its multi-layered growth plan over the next 24 months," the team said in its memo to clients.

The company posted excellent numbers in the February reporting season, more than doubling its revenue and boasting strong cash flow.

All three analysts covering the $377 million company rate the stock as a strong buy, according to CMC Invest.