The Resmed CDI (ASX: RMD) share price has made an impressive recovery since its October 2023 depths. The medical equipment maker's shares are up 41% from their lowest lows, crawling from $21.14 to their current $29.90 level.

It's true, Resmed shares are not at the bargain basement prices they once were. Now trading on a price-to-earnings (P/E) ratio of 32 times FY2024 earnings, putting it on par with the global medical equipment industry average. There is hardly any upside from here, some might say…

I could be blowing some minds here. But I'm still invested in Resmed shares and expecting considerable gains to come.

Drug disruption overdone

A quick refresher. Resmed provides respiratory devices used to treat obstructive sleep apnea (OSA). It is suggested that around 70% of people suffering from OSA are obese. One would then assume the two are somewhat linked.

Then glucagon-like peptides (GLP-1) agonists came along — a medication found to reduce weight rapidly. People have flocked to the drug, with its promise of effortless weight loss with a single injection per week.

As it stands, some research indicates GLP-1s may improve sleep apnea. United States pharmaceutical giant Eli Lilly and Co (NYSE: LLY) is studying how its GLP-1 variant affects sleep apnea, with results anticipated in the coming months.

I'm speculating here, though, I suspect the drug will help reduce the severity of OSA but not eliminate it. Complete elimination might occur for those small numbers of people who experience minor sleep apnea to begin with.

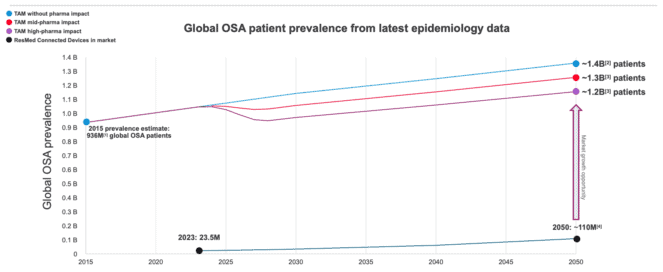

This is supported by Resmed's internal estimates, as shown above. Under the most impactful scenario, GLP-1s may reduce the global market opportunity in 2050 from 1.4 billion people to 1.2 billion.

My Resmed share price estimate

I believe Resmed is an exceptional company with quality products in a growing industry.

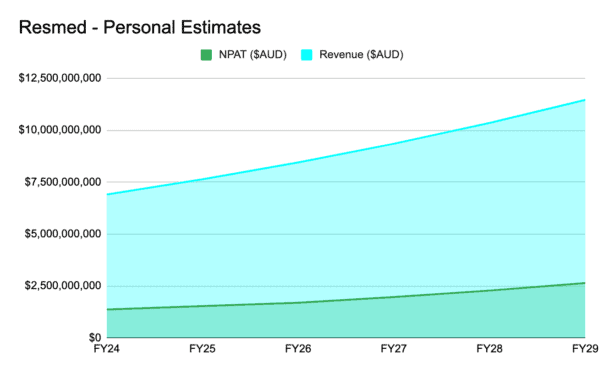

Although this company already looks large, the enormous market for sleep apnea devices provides a long runway for expansion. For this reason, it seems completely feasible — in my opinion — that Resmed continues to increase its revenue by 10% to 12% each year.

Based on this, I expect Resmed to generate A$9.34 billion in revenue in FY2027. Likewise, net profits after tax (NPAT) of A$1.96 billion seems achievable. That would peg the market capitalisation at A$41.46 billion at a reasonable P/E ratio of 28 times — approximately 18% above the current Resmed share price.

You might say, "But Mitchell, that is three years away…" And yes, you're right. However, with connected devices expected to increase more than fourfold between now and 2050, I doubt the growth will stop there.

By FY2029, I think Resmed could pull in A$2.63 billion in after-tax profits. I believe a market cap of around $70 billion would be possible then. That would equate to about $47.80 for the Resmed share price.