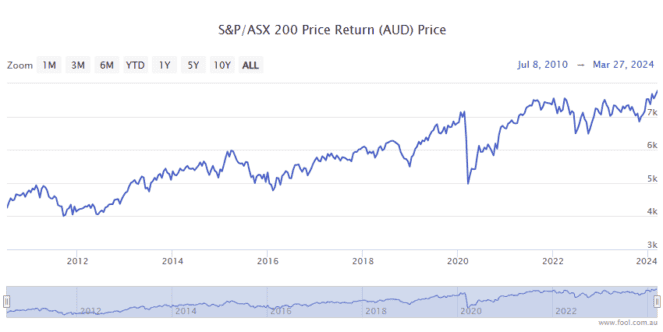

The S&P/ASX 200 Index (ASX: XJO) has done it again. By 'it', I mean launched into new all-time highs.

In morning trade, the benchmark index hit 7,888.3 points, resetting the prior intraday record high of 7,853.1 points.

That record was notched on 8 March, which saw the ASX 200 close at 7,847.0.

Boom!

OK. There may not have been a sonic boom just now. But I reckon there should have been.

ASX 200 on a record-breaking charge

March has been a record-breaking month for the ASX 200.

The Aussie benchmark index recorded a new intraday high of 7745.6 points on 1 March and another new intraday high of 7769.1 points on 4 March.

When the index of top 200 listed Aussie companies again reset that record high on 8 March, I wrote, "If the past two weeks are anything to go by, that record may not stand for long!"

Indeed, it did not.

It's a similar story in the United States, where the S&P 500 (INDEXSP: .INX) closed up 0.9% overnight to reset its own record close.

The tailwinds propelling Aussie and international stocks higher are much the same as they've been all month.

Namely increasing confidence that inflation is coming under control across the developed world, raising investor hopes of interest rate cuts on the horizon.

Markets have also been bolstered by resilient company earnings reports, optimism over the growth prospects offered by AI, and the outlook for a soft landing for both the US and Aussie economies.

What the experts are saying

Commenting on the record run for the ASX 200, Sean Sequeira, chief investment officer at Australian Eagle Asset Management, said (quoted by The Australian Financial Review), "The rally is focused on miners today, so that's an indication of a cyclical upswing and more comfort with the outlook for the global economy."

Indeed, the BHP Group Ltd (ASX: BHP) share price is up 1.7% in morning trade, with Rio Tinto Ltd (ASX: RIO) shares up 1.5% and Fortescue Metals Group Ltd (ASX: FMG) gaining 1.2%.

"The banks' rally had taken a lot of the money flow from some of the more stapled earnings stocks, and now the market might be rotating into these cyclical businesses," Sequeira added.

Ongoing strength in physical gold markets is also supporting the market.

The S&P/ASX All Ordinaries Gold Index (ASX: XGD) – which also contains some smaller miners outside of the ASX 200 – is up 2.5% at the time of writing.

"A rising gold price suggests the market expects further falls in inflation should support the central banks move to cut rates later this year. Safe haven demand also remains strong," Australia and New Zealand Banking Group Ltd (ASX: ANZ) analysts noted.