As long as you understand the risk and diversify your portfolio, there is nothing wrong per se with buying some speculative shares.

So if you are in that mood, here are two ASX shares considered suitable for those who are willing to tolerate some risk:

Top ASX shares for a business with a plan to become a world leader

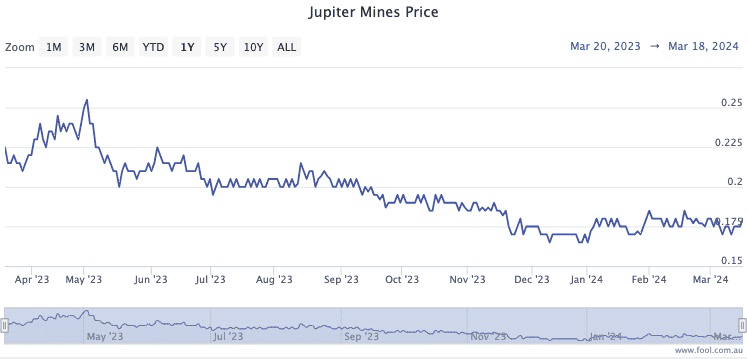

Manganese miner Jupiter Mines Ltd (ASX: JMS) has seen its share price plunge more than 25% since May.

However, Sequoia Wealth Management senior advisor Peter Day likes the direction the company is heading.

"The company previously released a strategy update, outlining a five-year plan to become the leading manganese producer in the world," Day told The Bull.

"The company has a long life, open pit manganese mine with an integrated ore processing plant in South Africa."

Day, while admitting the stock is not for the faint-hearted, noted the business is ramping up.

"Mining volumes in the first half of fiscal year 2024 were up compared to the prior corresponding period."

Day has good support among his peers. Broking platform CMC Invest shows all three analysts covering Jupiter Mines rating it as a strong buy.

How delayed is the gratification for these shares?

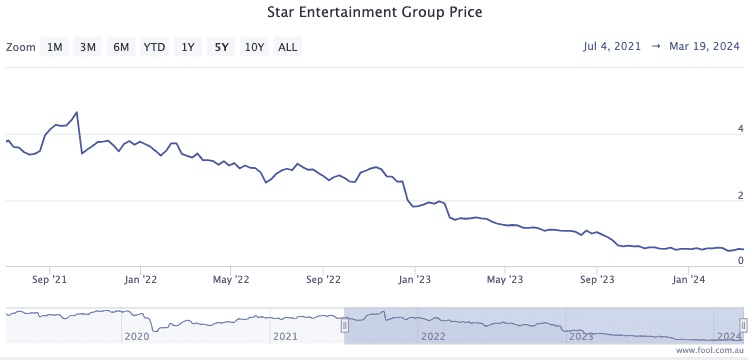

Casino operator Star Entertainment Group Ltd (ASX: SGR) has been crushed under regulatory scrutiny over the past couple of years.

Painfully the share price has lost more than 86% since October 2021.

Just when investors thought they might get some relief, a bombshell landed last month.

"The New South Wales Independent Casino Commission is holding another inquiry to investigate whether Star Entertainment is suitable to hold a Sydney casino licence," said Day.

"A final report is due on May 31."

Eventually, the business is bound to recover from its failings, but the second probe makes this an even more speculative buy than it was already.

"The company generated net revenue of $865.7 million in the first half of fiscal year 2024, down 14.6% on the prior corresponding period."

Other experts are more divided on this one than Jupiter Mines. Five out of 10 analysts currently surveyed on CMC Invest consider Star Entertainment a buy at the moment.