According to conventional wisdom, ASX mining stocks are notoriously cyclical.

And that is true in most circumstances. Global prices for any mineral swings up and down wildly according to the health of the economy and the subsequent demand.

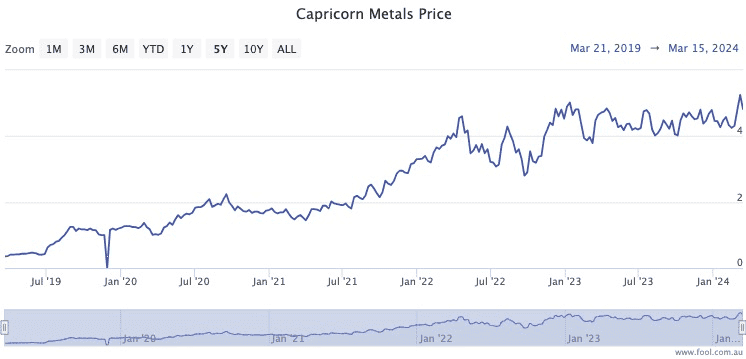

But there is one S&P/ASX 200 Index (ASX: XJO) company specialising in one particular metal whose shares have been trending up for five years now.

Let's check out what happened:

When no one used the term 'social distancing'

Capricorn Metals Ltd (ASX: CMM) is a gold miner with interests in Western Australia.

Cast your mind back to before anyone had even heard of COVID-19.

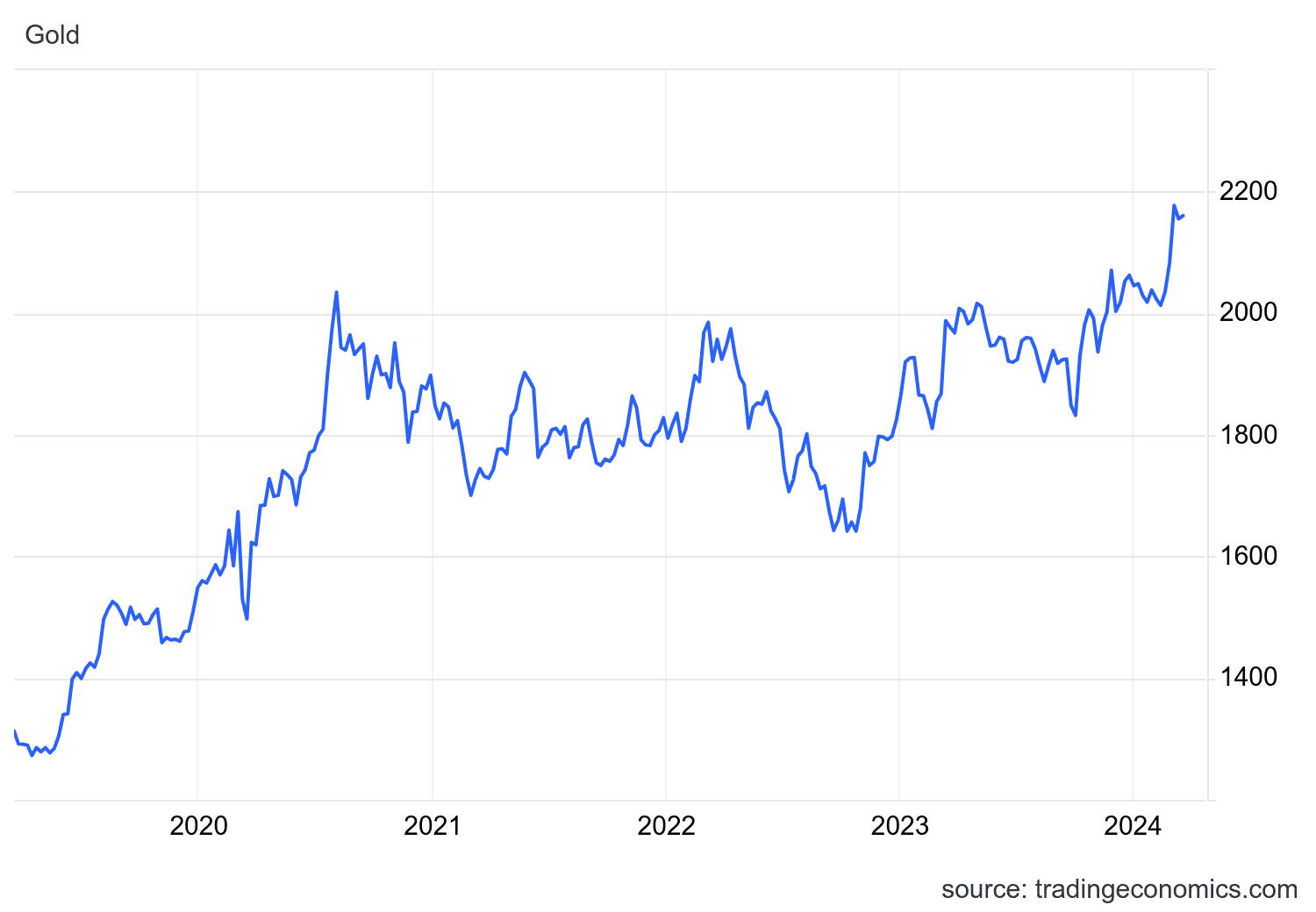

In 2019, interest rates around the world were near zero. Money was cheap and inflation was non-existent.

Gold, long considered a safe haven investment, was totally ignored. It was an old school, non-productive asset that no one wanted.

If you had the good fortune of buying Capricorn shares — let's say $20,000 worth — you will have done pretty well.

Because in December 2019 the planet changed from Wuhan outwards.

A true black swan event, the coronavirus pandemic turned the global economy upside down.

Investors flock to gold mining stock

While the world may have moved on from lockdowns and even vaccinations, economically it's now in a completely different place to what it was in 2019.

Inflation is cooling but still uncomfortably high. Interest rates are much higher than near-zero, and could stay that way for years.

Then just as the globe started moving past the pandemic, a war in eastern Europe broke out. Then another in the Middle East just 18 months after.

People have been reminded that anything can happen.

In such uncertain and frightening times, investors have flocked back to the comfort of gold.

And among the gold miners, in Bell Potter's words, Capricorn Metals sets the standard.

"Capricorn Metals is a sector-leading gold producer with a strong balance sheet and a management team with an excellent track record of delivery," it stated in a memo to clients this month.

"Its costs are among the lowest in the sector and it consistently generates strong cash margins."

So what about that $20,000 you invested in 2019?

After just five years, that nest egg is now $277,777.

Thank you, compounding.