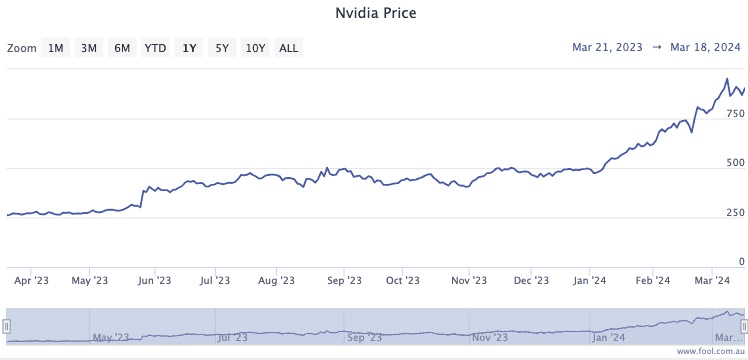

If you're kicking yourself that you missed Nvidia Corp (NASDAQ: NVDA)'s 240% gain over the past year as artificial intelligence (AI) became the topic du jour, never fear.

Nvidia stock is not the only AI game in town, so EAM Investors chief Travis Prentice reckons there are plenty of opportunities still out there.

"We're… seeing strong, accelerating trends in everything levered to AI and believe there will be meaningful beneficiaries of the AI buildout in small cap companies globally, not just in the 'Magnificent Seven'."

A useful tip he gave is that they don't have to be computing or even technology stocks.

"Obviously, we see massive opportunities broadly within key enabling technology providers in the space, but also in general industrials that are key beneficiaries of the necessary build in infrastructure to support these large data centres and compute loads that AI requires."

The Motley Fool Australia asked US-based Prentice what some of those lateral ideas could be, and he named three stocks his fund is invested in:

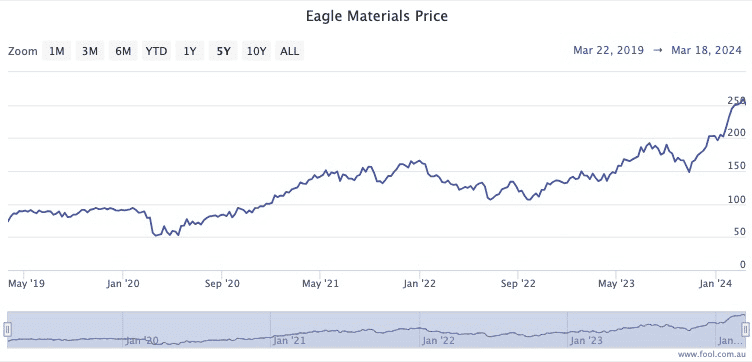

First you have to construct the buildings

Eagle Materials Inc (NYSE: EXP) is a Texas company that makes building materials such as gypsum, concrete and wallboards.

It's comparable to ASX staples James Hardie Industries plc (ASX: JHX) and CSR Ltd (ASX: CSR).

Prentice reckons that the business will benefit from all the facilities that need to be built to house all the computers that will quench the world's thirst for AI.

"Beneficiary of infrastructure build in general, including onshoring of manufacturing/building out of data centres," he told The Motley Fool.

"Primarily visible by their pricing power/tight supply conditions driven by demand for cement/aggregates in their non-residential side of their business."

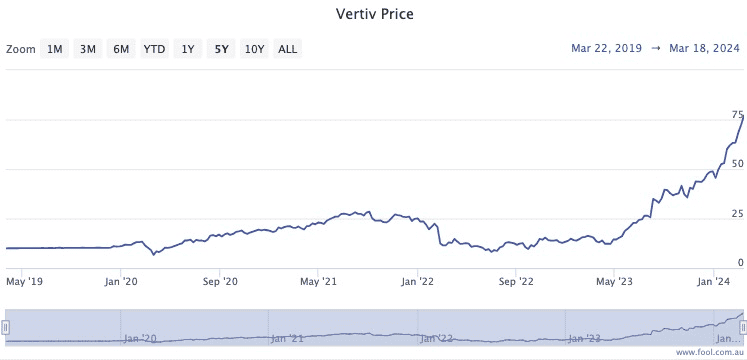

Then you build the data centres within

A bit further down the supply chain is Vertiv Holdings Co (NYSE: VRT), which actually builds and operates data centres.

Thus Prentice said that it is a "more of [a] direct beneficiary within the data centre build".

"Company provides power and thermal solutions in the data centre, most notably their strong market position in liquid cooling for high density compute applications."

Believe it or not, over the last 12 months, Vertiv shares have outperformed Nvidia stock, rocketing more than 480% in that time.

All up the stock has risen an amazing 830% since July 2022.

Finally, fit out the data centres

On the other side of the world is Taiwanese outfit King Slide Works Co Ltd (TPE: 2059).

Prentice explained that it "engages in the manufacturing and design of furniture hardware and accessories".

"It also happens to have a strong portfolio of and customisation capabilities for server rail kits that help manage thermal issues and house AI servers in the data centre."

King Slide shares have not slid at all, but have climbed a similar path to Nvidia in the past year, rising 245%.

To demonstrate the impact of the AI hype, all its gains over the past five years have been made in the last 12 months.