Many Australians have the impression that investing in stocks is only for rich people.

But that cannot be further from the truth.

If you have just $500 you could make a pretty useful start to a portfolio.

I have taken the liberty of picking out the best ASX shares that could be ideal purchases for a few hundred dollars.

And for diversification, they're all a bit different to each other.

One is a reliable growth exchange-traded fund (ETF), another is an explosive pharmaceutical stock that's in a dip currently, and the third is a cloud computing and artificial intelligence (AI) play that's already soared in recent times.

The best ASX shares for diversification

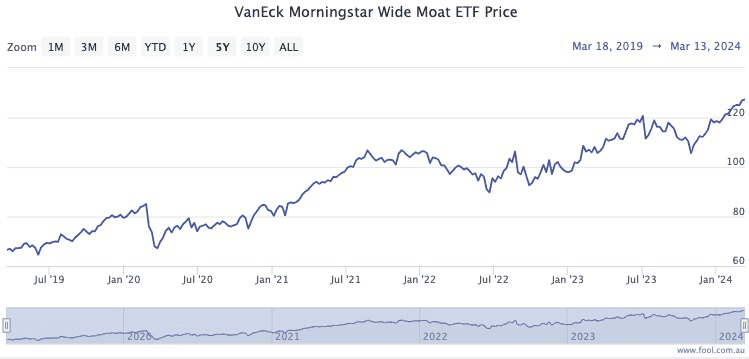

Regardless of how much you have to spend, I am a big fan of Vaneck Morningstar Wide Moat Etf (ASX: MOAT) as an excellent starter stock for a new portfolio.

This ETF tracks the constituents of the Morningstar Wide Moat Focus NR AUD Index, which are companies that are judged to have the biggest competitive advantages over their rivals and potential rivals.

Morningstar and many other investors call this concept an "economic moat".

Looking at the current constituent list, there are some familiar brands such as Walt Disney Co (NYSE: DIS), Alphabet Inc (NASDAQ: GOOGL) and Nike Inc (NYSE: NKE).

Another benefit of the Wide Moat ETF is that the US stocks provide diversification from your other ASX holdings.

Chuck $500 on this one.

The ASX stock with explosive potential

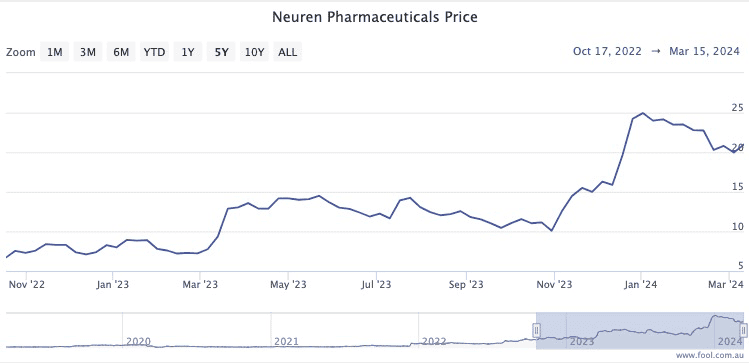

Neuren Pharmaceuticals Ltd (ASX: NEU) was the best performer in the S&P/ASX 200 Index (ASX: XJO) last year with a spectacular 214% climb.

This year hasn't been as kind though, with the healthcare company taking a 22.4% dive so far in 2024.

"A short report targeting Neuren's US partner, Acadia Pharmaceuticals Inc (NASDAQ: ACAD), combined with unexpected holiday-period seasonality in sales for its flagship drug, Daybue, shook investor confidence," Elvest analysts said in a memo to clients.

They are still confident in the Melbourne outfit's long-term outlook.

"Our thesis for Neuren Pharmaceuticals is unchanged. New CY24 Daybue sales guidance of US$370 to US$420 million (+120%) underpins another solid year of royalty and milestone revenue for Neuren."

All six analysts currently surveyed on CMC Invest reckon Neuren is a buy.

The best ASX shares to invest in artificial intelligence

While the ASX is short on companies that directly produce generative artificial intelligence, Nextdc Ltd (ASX: NXT) is going gangbusters.

As a provider of data centres, the company is enjoying high demand from the intensive resources required for AI and cloud computing generally.

To celebrate February 29, Moomoo market strategist Jessica Amir declared NextDC as one of the stocks she would buy and hold until the next leap year.

The business is at a "tipping point", she said.

"Positioned to capture [and] generate AI opportunities… Market is telling you that it's exciting about its future and that it's essential in AI.

"Half of its revenue is from NSW and ACT — huge potential to expanding capacity and geographically — and it's doing that."