There is no sweeter action in stock investing than picking up S&P/ASX 200 Index (ASX: XJO) stocks for cheap then watching it grow while everyone else catches up.

So in that spirit, there are two shares that Baker Young analyst Toby Grimm reckons are ripe to buy at a discount right now:

Take a long-term view of this ASX 200 beauty

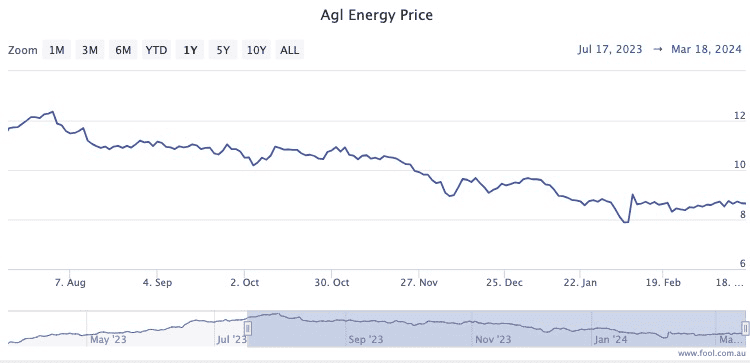

The AGL Energy Limited (ASX: AGL) share price has tumbled more than 29% since last August's reporting season.

The company has had many governance issues and boardroom fights over the past couple of years, but those problems seem to have largely settled down now.

The latest numbers were pretty good, Grimm told The Bull.

"The energy giant's share price has continued to languish despite releasing better-than-expected first half earnings in fiscal year 2024 amid upgrading full year guidance."

The trouble is that, after years of elevated prices, investors have been pricing in a weaker wholesale electricity market in 2025.

"Taking a longer term view, we believe the stock is materially undervalued," said Grimm.

"Stronger earnings provide a solid foundation to fund renewable energy investments."

AGL currently enjoys decent support from the professional community.

Broking platform CMC Invest shows eight out of 11 analysts recommending the stock as a buy.

Dividend producer that could rocket later this year

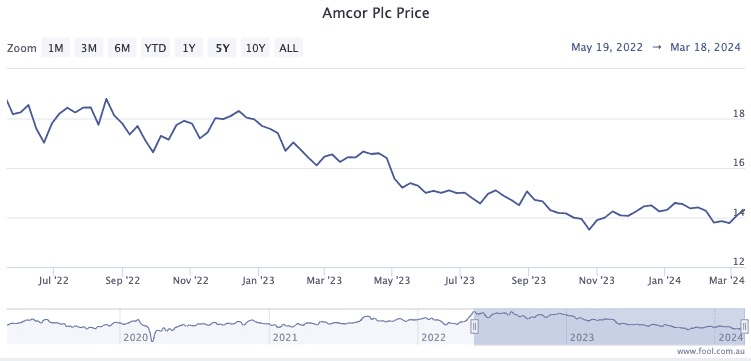

Packaging giant Amcor CDI (ASX: AMC) has struggled to launch upward momentum in its shares for a while now.

The stock is down more than 21% since December 2022.

Amcor has, however, handed out consistent dividends at a 5.3% yield, soothing the experience for its shareholders.

Grimm admitted last month's reporting season did not flatter the global business headquartered in Zurich.

"The global packaging giant reported a soft set of results for the six months ending December 31, 2023, as customers in key markets delayed inventory restocking amid tougher retail conditions."

There is a light at the end of the tunnel though.

"We see potential for a recovery later this year, as the company cuts costs and customer re-stocking improves," said Grimm.

"We view the stock as attractive value at current levels."