I didn't buy Zip Co Ltd (ASX: ZIP) shares on 9 October.

But I sure wish I had.

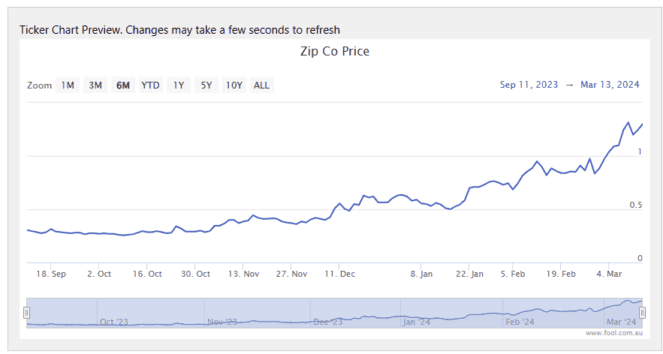

Shares in the All Ordinaries Index (ASX: XAO) buy now, pay later (BNPL) stock have taken off over the past six months.

Here's what's been boosting ASX investor sentiment.

Zip shares have been rocketing

Although Zip shares remain well down from their February 2021 highs, the stock has enjoyed a remarkable rebound over the past six months.

Stock markets are often said to be forward-looking.

And while the market doesn't always get it right, in the case of Zip shares, the steady march higher that began in October looks prescient.

Zip's half-year results for the six months to 31 December showed increased customer engagement and boosted revenues.

Total transaction volume (TTV) for the half-year increased by 9.6% from the prior corresponding half-year to $5 billion, with TTV in Zip Americas notching a record half-year after growing by 33.3%.

Cash profits were up 45.9% year on year to $176 million. And the company's revenue margin of 8.5% was up 1.30% year on year.

Zip CEO Cynthia Scott also painted an optimistic picture for Zip shares for the year ahead.

"We remain firmly focused on our three strategic pillars for FY24 – driving sustainable, profitable growth, product innovation and operational excellence," she said.

Scott added, "Zip is very well-positioned to capitalise on the near and medium-term opportunities in our core markets of ANZ and the Americas and deliver greater value for our customers and merchants."

And boom!

Now, the day before those half-year results were released on 27 February, Zip shares were already trading for 94 cents apiece.

But if I'd bought shares on 9 October, less than six months ago, I could have picked them up for 25.5 cents apiece.

Meaning my $5,000 would have netted me 19,607 Zip shares and some pocket change.

At market close on Friday, the ASX 200 BNPL stock was trading for $1.25 a share.

So, my $5,000 investment would be worth an enviable $24,508.75 today!