There is a lot going on at any given time in financial markets, but there are simply some stocks that have catalysts ready to bust out.

Moomoo market strategist Jessica Amir has picked out three such shares that investors cannot afford to take their eyes off at the moment:

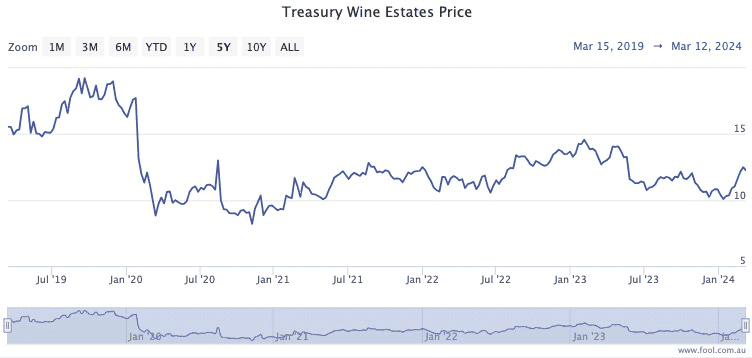

The ASX stock robbed overnight that could get it all back

Back in 2020, the Chinese government took offence to calls from Canberra for an independent enquiry into the origins of COVID-19.

As economic retaliation, Beijing slapped on punitive tariffs on a range of goods imported from Australia.

That included wine, and Treasury Wine Estates Ltd (ASX: TWE)'s biggest overseas market disappeared overnight.

"Since 2021, Australia's wine industry has suffered tariffs of up to 220% on imports into China," said Amir.

Now, with a different party in charge in Australia, diplomatic relations have thawed somewhat.

And this could soon provide Treasury Wine shares a huge boost.

"The bets are in — it won't be long before the Australian wine industry reclaims access to the Chinese market following the Chinese Ministry of Commerce's proposal to lift the exorbitant tariffs on Australian wine imports."

Already the international forecast for wine consumption is looking positive.

"The company has a rosy outlook with its top-line stable of wines seeing greater sales and its shares moving up 22% from their lows."

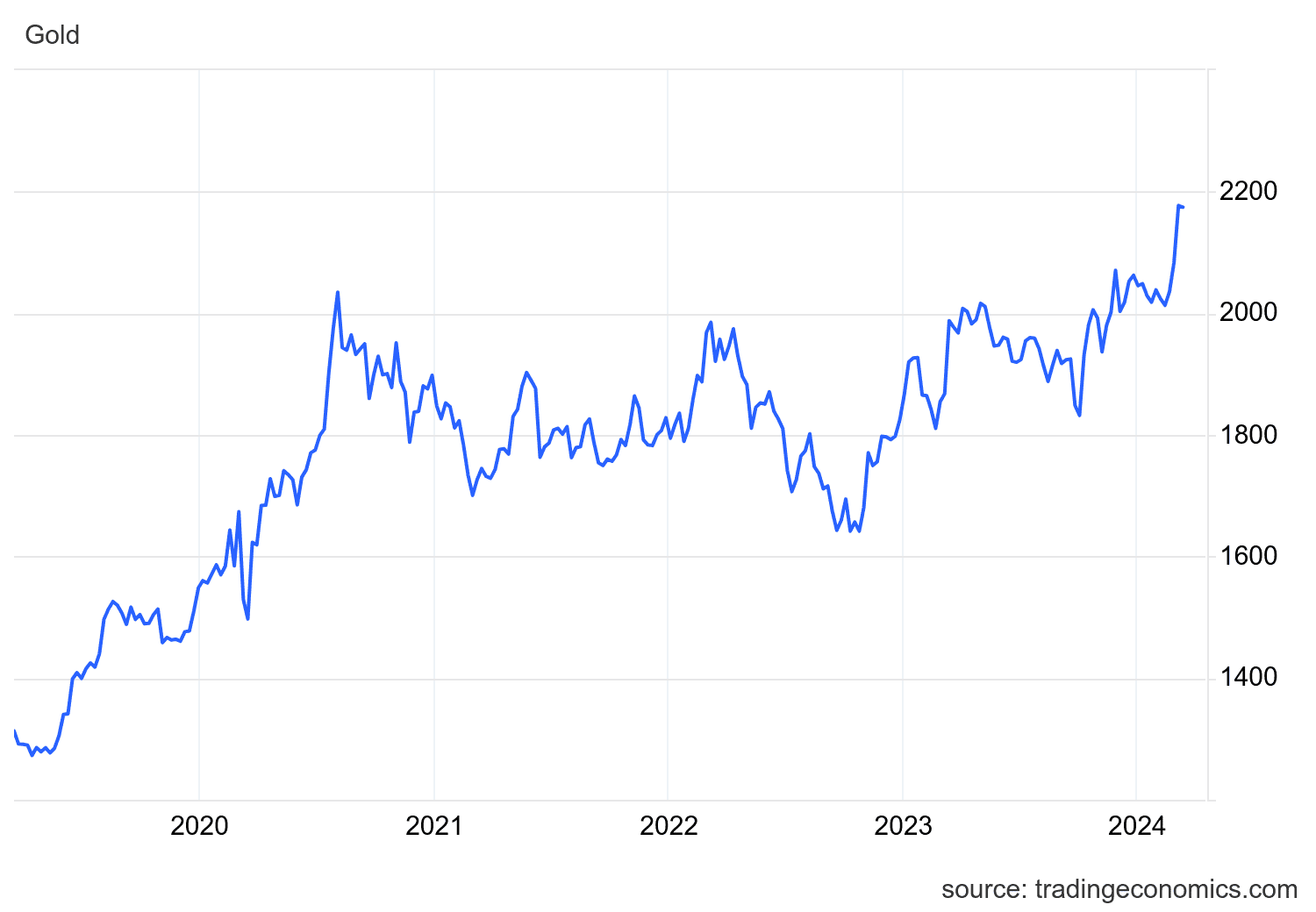

Gold will never go out of fashion

For Amir, gold could be the "undervalued investment opportunity" of the year.

The global gold price is on an upward trajectory at the moment, rising about 30% since October 2022.

And she's noticed the Newmont Corporation CDI (ASX: NEM) share price has now risen 15% from a five-year low.

"Given that the US Federal Reserve will soon cut interest rates, we're likely to see Australia follow suit and stimulate spending in the near future.

"Newmont has great global exposure and [i's] a potential share to consider for those looking to add gold to their portfolio."

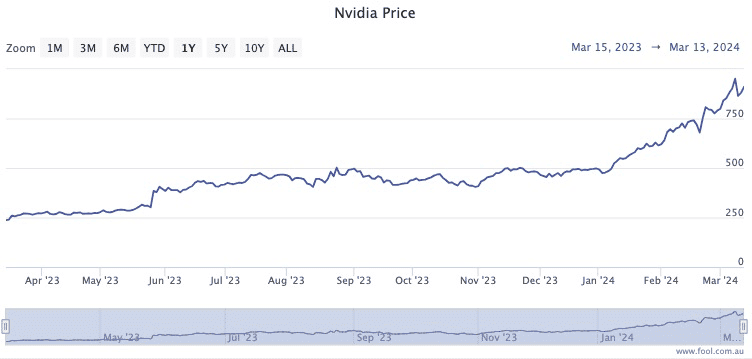

The hottest stock in the world

It's hard to talk about the hottest shares to watch these days without at least mentioning Nvidia Corp (NASDAQ: NVDA) in passing.

The stock was driven to an all-time high last week thanks to the huge demand for its chips to run artificial intelligence, before a pullback from profit-taking.

"It's already seen a surge in its stock value following its recent setback."

There is a potential catalyst in the coming days that investors need to monitor, according to Amir.

"Next week, Nvidia will be heading up the Nvidia GTC conference in San Jose California, the number 1 AI conference in the world.

"With fresh ideas and hype, Nvidia is likely to continue its upward trajectory despite its profit-taking dip at the end of last week."