With the S&P/ASX 200 Index (ASX: XJO) rocketing more than 14% since the start of November, stock selection has now become critical.

After all, you don't want to be buying an ASX stock after it has already become expensive. Every cent you overpay eats into your future profit.

So here's my take on three ASX shares that I think still have plenty of room to impress:

Exposure to mining without buying mining stocks

The trouble with mining shares is their cyclicality and volatility.

Commodity prices can fluctuate wildly up and down, so the fortunes of the companies that produce minerals are unpredictable.

However, if you still want to be exposed to that sector, buying shares in a supplier might be a more reliable way to go.

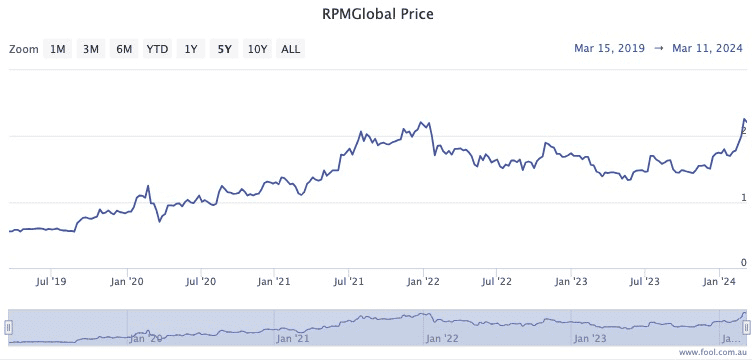

RPMGlobal Holdings Ltd (ASX: RUL) provides technology and solutions to clients in the resources sector.

Over the past five years, even through COVID-19 and the inflation crisis, the RPMGlobal stock price has rocketed 313%.

And with both western and Chinese economies bound to improve in the coming years, I like the chances of this stock rising further.

Analysts at both Moelis Australia and Veritas Securities agree with me by rating RPMGlobal as a strong buy right now, according to CMC Invest.

The ASX shares that are never cheap are cheap right now

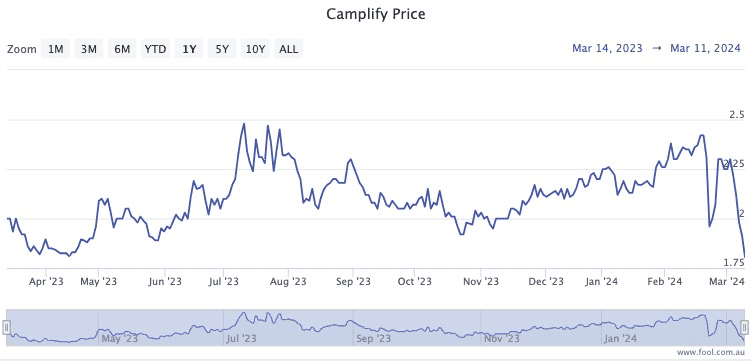

Camplify Holdings Ltd (ASX: CHL) might be very much a small cap at the moment, but its addressable market is huge.

The company operates a peer-to-peer platform that allows campervan owners to rent out their vehicles when not in use.

The startup, hailing from Newcastle in NSW, grew its revenue for the first half by a whopping 95.4%.

The market reacted negatively though, which the analysts at Morgans put down to "some seasonality" in a few metrics, such as future bookings and gross margins.

That team, plus Canaccord and Ord Minnett, are not the least bit worried about the future trajectory. All three are maintaining strong buy ratings for Camplify, as shown on CMC Invest.

This could mean that the current dip is a golden buying opportunity.

Bringing in revenue while developing future products

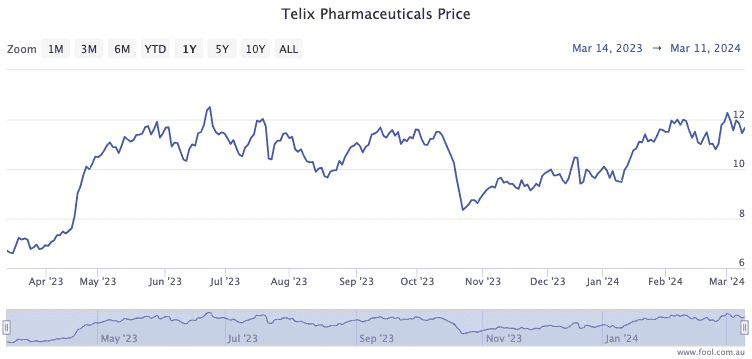

Telix Pharmaceuticals Ltd (ASX: TLX) continues to score goals in the tough industry of biotechnology and pharmaceutical development.

The shares are already up 11.8% so far this year, and 68% if you go back 12 months.

The great ace up its sleeve is that it already has one cancer product, Illucix, on commercial sale. This brings in revenue while it's working on other cancer diagnosis and treatment solutions.

The company recently announced its plan to acquire Canadian business ARTMS inc.

"The acquisition is crucial for the supply of 89Z and the pending rollout of Zircaix for renal cancer imaging," Bell Potter analysts said in a memo.

"Telix is validating multiple production locations for 89Zr in the US using the ARTMS core technology. The company also owns significant quantities of ultra-pure 89Y, being the raw material for production of 89Zr."