Investors in S&P/ASX 200 Index (ASX: XJO) shares have been keeping a close eye on the pending end to elevated inflation levels.

As you likely recall, inflation took off from historically low levels in early 2022, spurred by the government's massive pandemic stimulus measures. Inflation in Australia reached an eye-watering 7.8% in December 2022. It gradually reduced over the next year, falling to 4.3% in December 2023.

And the monthly CPI indicator for the 12 months to January 2024 came in at an even lower 3.4%.

That's coming closer to the RBA's target range of 2% to 3%.

Which is good news for most ASX 200 shares.

Unless the trend reverses.

How inflation can throw up headwinds for ASX 200 shares

High inflation can negatively impact ASX 200 shares in a number of ways.

First, it reduces the amount of money many consumers have to spend, which can see less revenue flowing in for many Aussie companies.

Second, high inflation comes hand in hand with higher interest rates. That's going to hurt any companies holding high levels of debt or those priced with future earnings in mind.

And many companies can't readily increase their prices to match these increased costs without further impacting their business.

So, there are good reasons investors in ASX 200 shares are hoping we've seen an end to the past two years of elevated inflation.

But a number of market experts are cautioning those hopes may be premature.

Addressing The Australian Financial Review Business Summit yesterday, BlackRock global chief investment strategist Wei Li said, "In the near term, markets may not be appreciating how quickly inflation can fall through the simple mechanics of the pandemic unwind."

Li continued:

In the long-term, markets may not be appreciating how different the new regime is in terms of the supply side constraints… After inflation gets to target, it could cause a roller coaster rebound back higher than what markets are currently expecting.

Li said the RBA may have to accept inflation at the upper end of its target, or 3%.

Former federal treasurer Peter Costello also offered some sobering views on inflation and interest rates.

According to Costello:

The market now believes that interest rates have peaked, and they are going to fall, and have priced in those interest rate reductions. What happens if they don't materialise as soon as the market expects? There is a fair bet to make that the market may have run beyond itself.

If inflation is poised for an unwelcome rebound, this is the ASX 200 share I'll be buying.

An inflation-busting ASX stock

Running my slide rule over inflation-resistant ASX stocks, I looked for companies whose services will remain in strong demand even if price rises continue to hit consumers' discretionary spending.

Importantly, I also looked for ASX 200 shares that have demonstrated they can pass on inflationary costs to their customers.

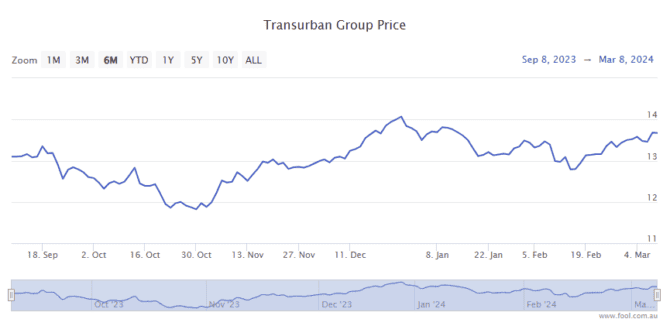

Enter, toll road developer and operator Transurban Group (ASX: TCL).

Transurban reported its half-year results (1H FY 2024) on 8 February.

Highlights included a 2.1% year on year increase in the company's Average Daily Traffic (ADT) numbers, which reached 2.5 million trips per day.

This helped drive a 6.3% increase in proportional toll revenue to $1.76 billion.

And Transurban upped its interim dividend by 13% to 30 cents per share. The stock currently trades on an unfranked trailing yield of 4.6%.

On the expenditure side, Transurban's operational costs increased by 1.7%. That ran below inflation, so in real terms, costs fell over the six-month period.

And this ASX 200 share is well positioned should inflation in Australia or North America rebound.

In 1H FY 2024, 67% of the company's revenue had CPI-linked tolling escalations.

And in the unexpected scenario where inflation reverses, most of Transurban's tolls cannot be lowered as a result of deflation.