Sometimes history can be a good teacher. As 26th US President Theodore Roosevelt said, "The more you know about the past, the better prepared you are for the future." And if the last 10 years of the All Ordinaries (ASX: XAO) is anything to go by March could be a prime opportunity for scooping up cheap ASX shares.

As with most things in life, markets tend to ebb and flow in a seasonal stream. The Santa rally, tax time selling, and other timely phenomena are clear examples of how share prices fluctuate depending on the time of the year.

However, it should be noted that the market also has a habit of being unpredictable. If past patterns mirrored the future, we'd all be rich. So, taking these patterns with a grain of salt is important — they are always susceptible to change.

What does history show?

Although it is far from certain, the past 10 years of data suggest this month could produce a fall in the All Ords index. Ironically, the Aussie benchmark of the 500 top ASX shares is up 1.9% as of Friday afternoon. Still, 21 days are left in March, so we best not count our chickens before they hatch.

So, what do the last 10 years say about March and whether it is primetime for buying cheap ASX shares?

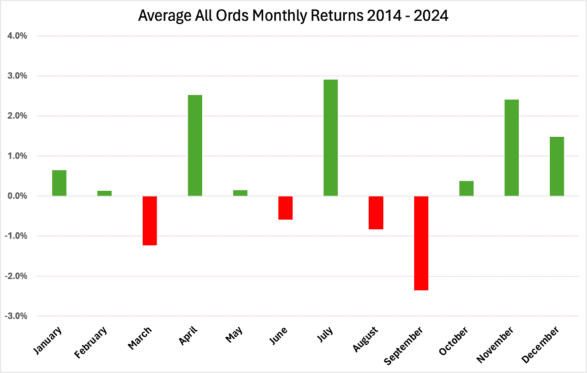

Well, the average return of the All Ords in March between 2014 and 2024 is a 1.2% decline. The only month to have performed worse is September, diving 2.4% on average over the past decade. Based on this, history would suggest this is one of the best times (second to September) of the year to be a buyer of shares.

If we inspect the data further, I find the following interesting information:

Best March return in the past 10 years: 6.4% increase in March 2022

Worst March return in the past 10 years: 21.5% fall in March 2020

The catastrophic crash in 2020 due to the COVID-19 pandemic drastically impacted the average March return. If we remove this outlier, the average for this month jumps to a 1% gain.

Which ASX shares could be cheap?

History aside, if March pans out to be a good month to buy shares, what companies are currently cheaply valued?

It's almost a loaded question because a reduced share price doesn't always present value. Sometimes the 'cheap ASX shares' are the ones with share prices soaring ahead as the rest of the market trembles.

Even so, a low forward price-to-earnings (P/E) ratio can sometimes be a decent starting point.

Some of the most cheaply rated companies inside the ASX All Ords right now include:

- Macmahon Holdings Ltd (ASX: MAH) — 4.7 times forward P/E

- AGL Energy Limited (ASX: AGL) — 7.7 times forward P/E

- Fortescue Ltd (ASX: FMG) — 9.2 times forward P/E

It always pays to delve deeper, beyond the P/E ratio, to understand better whether an ASX share is truly cheap.