Just $9,000 could start your journey into the delicious world of passive income.

In fact, I reckon you're in with a shot of generating a perpetual monthly payment of $500 if you play your cards right.

Don't believe me?

Check out this hypothetical:

Go the growth shares, I reckon

With $9,000, I would construct a diversified portfolio of ASX growth shares.

Although the Australian stock market suffers from the stereotype that it's dominated by dividend stocks, there are plenty of excellent growth investments out there.

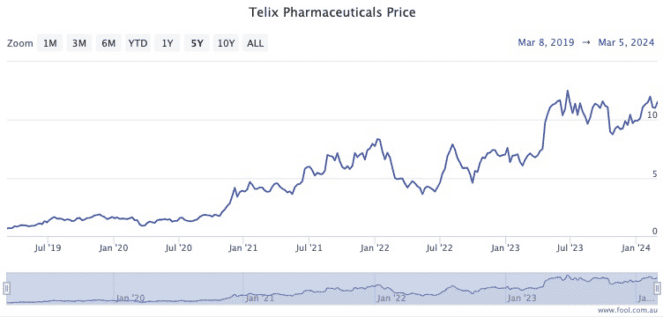

Take Telix Pharmaceuticals Ltd (ASX: TLX) and Audinate Group Ltd (ASX: AD8), for example.

Both are well established businesses mature enough to be in the S&P/ASX 200 Index (ASX: XJO).

Yet the Audinate share price has soared more than 305% over the past five years, equating to a compound annual growth rate (CAGR) of 32%.

As for Telix? Its investors are tickled pink as the stock returned a mind-blowing 1,647% in the last half-decade.

That's a CAGR of 77%.

So I reckon it's within the realms of possibility that you could build a portfolio that could average 13% of growth a year.

Passive income later requires discipline now

That's not all though.

You want to keep saving and adding to this investment.

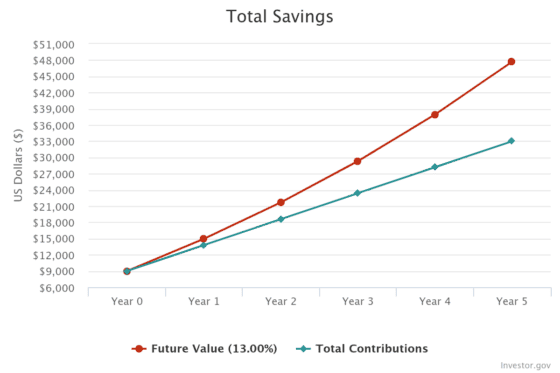

If you can spare $100 a week or $400 a month, the nest egg will grow in no time.

After just five years of that savings discipline with a CAGR of 13% will see the portfolio reach $47,687.

Beyond that, try selling off the 13% return each year instead of leaving it in the portfolio.

That will reap an average of $6,199 per annum, which is $516 of monthly passive income.

Whoomp, there it is.

What if that passive income isn't enough though?

You just need to add patience to the pot.

Let the portfolio grow for 10 years instead of five, and it will have hit $118,965.

From that point on if you cash in your winnings each year that's a cool $15,465. In monthly terms, that's $1,288 of passive income.

Nice work.