The S&P/ASX 200 Index (ASX: XJO) might have risen four months straight, but many experts are still bullish about the rest of 2024.

Shaw and Partners portfolio manager James Gerrish said in his newsletter that his team is "bullish equities through 2024/5".

"The ASX is stronger than many probably give it credit for.

"If/when the resources sector enjoys a bid, the ASX 200 will be knocking on the 8000 door. e.g. The index's largest stock, BHP Group Ltd (ASX: BHP), is still trading over 13% below its 2024 high."

So in this upbeat environment, which Australian shares are best set to elevate to the next level?

Here are four to consider:

When mining rises, so does this stock

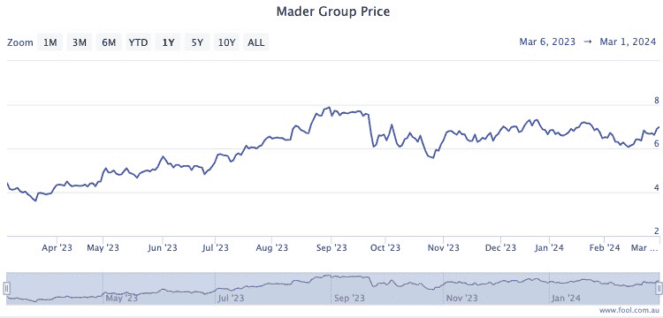

Mader Group Ltd (ASX: MAD) is a maintenance contractor for clients in the mining industry.

Like Gerrish mentioned, the resources sector is in a low part of its cycle at the moment, so Mader shares are also down about 19% since September.

The stock even plunged after quarterly results that didn't look that bad in January.

But that gives it a low base off which to jump in 2024.

This theory will apply especially if western economies start recovering as a result of interest rate relief, and China begins stimulus to fight deflation.

All five experts surveyed on broking platform CMC Invest reckon Mader Group is a buy.

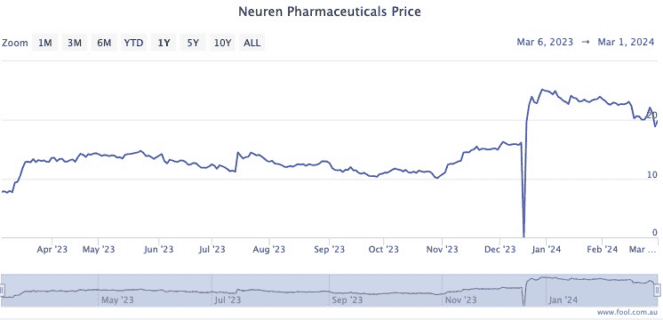

Shrug off the short sellers

A short seller attack on Neuren Pharmaceuticals Ltd (ASX: NEU) has seen its share price plummet almost 21% so far this year.

Analysts at Elvest Fund, which holds the stock, explained it best in a memo to clients.

"A short report targeting Neuren's US partner, Acadia Pharmaceuticals Inc (NASDAQ: ACAD), combined with unexpected holiday-period seasonality in sales for its flagship drug, Daybue, shook investor confidence."

But investors with years to invest need not worry.

"Our thesis for Neuren Pharmaceuticals is unchanged. New CY24 Daybue sales guidance of US$370 to US$420 million (+120%) underpins another solid year of royalty and milestone revenue for NEU.

"This will aid commercialisation of its exciting pipeline drug, NNZ-2591, which has the potential to grow Neuren's addressable market five-fold in the coming years."

These Aussie shares have been unstoppable

The resurgence of MMA Offshore Ltd (ASX: MRM) shares has been simply stunning.

Check out these figures: up 76% over the past 12 months, up 477% since the start of 2022, up 754% since September 2020.

It seems the marine services provider is supplying its clients with indispensable offerings, if the latest reporting season is anything to go by.

"The marine services provider reported a massive 339% jump in underlying net profit after tax (NPAT) to $39.5 million in 1H FY24," reported The Motley Fool's Bronwyn Allen.

"The company said there was stronger demand for its vessels and services."

Tellingly, all five professional investors surveyed on CMC Invest rate the stock as a strong buy.

'Double or triple the existing footprint'

Lovisa Holdings Ltd (ASX: LOV) is already on fire this year, enjoying a 24% increase in its stock price.

Elvest analysts loved the half-year report.

"EBIT [was] up 16% to $82 million, in part driven by a near record gross profit margin of 80.7%. Recent like-for-like sales turned positive, which bodes well for second half earnings."

But I think it can reach even higher, with the business expanding rapidly around the world.

The Elvest team agrees with this thesis.

"Looking beyond FY24, we remain excited about the company's aggressive global store roll[out] program, which could ultimately double or triple the existing footprint of 860 stores across over 40 markets."