When some punters see the words "52-week high" they immediately think it's too late to buy the stock.

But this is absolutely false logic. Shares don't care about the past. Only the future outlook is what matters.

If anything, S&P/ASX 200 Index (ASX: XJO) stocks hitting new peaks have momentum from investors who obviously like what the business has to offer.

And the ultimate aim of the game is to own shares that other people want.

So in this spirit, Shaw and Partners portfolio manager James Gerrish recently named two stocks that his team are bullish on that have been smashing year-long records:

Turning the tables on foreign takeovers

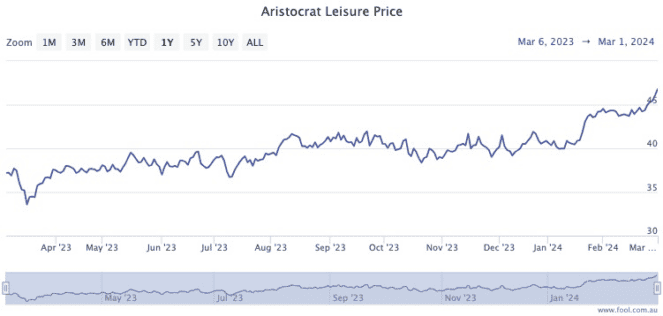

Poker machine maker Aristocrat Leisure Limited (ASX: ALL) has gained more than 14% so far this year to not only make 52-week highs but is nearing its all-time peak.

"Following its report last November, this gaming company doesn't confess its sins until May, but the markets are clearly voting with both feet that the news will be good," Gerrish said in his Market Matters newsletter.

"Their FY23 results were solid, with revenue up 13% to $6.3 billion and segment [EBITDA] up 4% to $2,750 million, at the time both slightly ahead of expectations."

Gerrish's team is backing the ASX 200 stock to keep heading upwards in the medium term.

"We think Aristocrat can continue to grow earnings at mid-single digits, amplified by share buybacks (i.e. fewer shares on issue) while enjoying a net cash position, even after completing the $1.5 billion acquisition of Nasdaq-listed gaming software giant NeoGame SA (NASDAQ: NGMS)."

The move is an attempt to expand into US online lotteries, which is turning the tables on what usually happens with mergers and acquisitions.

"A pleasant change to see an ASX company 'shopping' overseas."

'Buy the dip until further notice' on this ASX 200 stock

A poster example of how past performance has nothing to do with future is Audinate Group Ltd (ASX: AD8).

The share price for the audio networking technology provider has now rocketed 153% over the past year, but it remains a buy for many professionals.

This includes Gerrish's team, which has ridden the rollercoaster all the way up.

"We are not planning on taking profit on Audinate, even though a 160% paper gain is eye-catching."

The ASX 200 shares have been driven to all-time highs after last month's half-year results labelled as "very strong" by Gerrish.

"Revenue grew 48% to US$30.4 million, with EBITDA US$10.1 million being a whopping ~70% ahead of expectations driven by strong revenues, plus margins improved ahead of consensus.

"While the first half was strong, the company left guidance unchanged, but the market thoroughly embraced the results."

There could be some exciting corporate developments coming.

"They are looking at M&A opportunities with a strong cash balance of $117 million, which supports our view that this is a business going places.

"We can see a period of consolidation on the horizon, but we believe Audinate is a case of 'buy the dip' until further notice."