Experts have noticed a couple of S&P/ASX 200 Index (ASX: XJO) shares that, after a period of underperformance, are now just starting to capture the attention of the market.

They are both quality businesses in the finance/insurance field, so are rated as a buy right now:

'Rebounded strongly' despite weaker profit

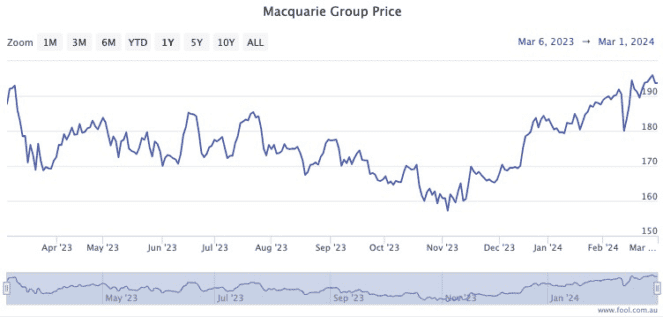

For eight months between March and November last year, the usually reliable Macquarie Group Ltd (ASX: MQG) shares plunged more than 18%.

But funnily enough, the stock has soared in recent weeks despite some concerns raised during the recent reporting season.

"The share price of this diversified financial services company rebounded strongly despite an update in February revealing a weaker net profit after tax to date for fiscal 2024 when compared to the prior period," Fairmont Equities managing director Michael Gable told The Bull.

"This is a bullish sign as it showed the share price was factoring in a lower result."

Macquarie shares have returned more than 50% over the past five years, all while giving out healthy dividends, which currently stands at a 3.6% yield.

The stock is now trading almost 22% higher than it was on 13 November.

"The stock has managed to remain in an uptrend. We expect Macquarie and the broader market to do well in calendar year 2024."

13 of 14 analysts love this ASX 200 stock

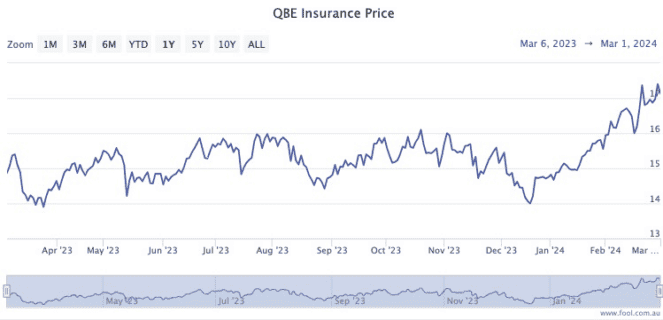

Insurers are a unique group that does well out of interest rate rises.

With that tailwind, QBE Insurance Group Ltd (ASX: QBE) reported excellent numbers last month.

"The insurance giant posted a significant increase in statutory net profit after tax to US$1.355 billion in fiscal year 2023 compared to US$587 million in the previous year," said Marcus Today equities analyst Matthew Lattin.

Lattin, who rates QBE as a buy, noted how the business was growing at a great clip.

"QBE's gross written premiums grew by 10%, supported by renewal rate increases and targeted new business growth, underscoring QBE's resilience and competitiveness.

"Despite a slight increase in expenses, effective cost-management strategies have kept the expense ratio at a relatively low 11.8%."

Similar to Macquarie, QBE also pays out a handy 3.6% dividend yield.

Lattin is far from the only professional bullish on the insurance provider.

A whopping 13 out of 14 analysts, as surveyed on CMC Markets, recommend the stock as a buy at the moment.