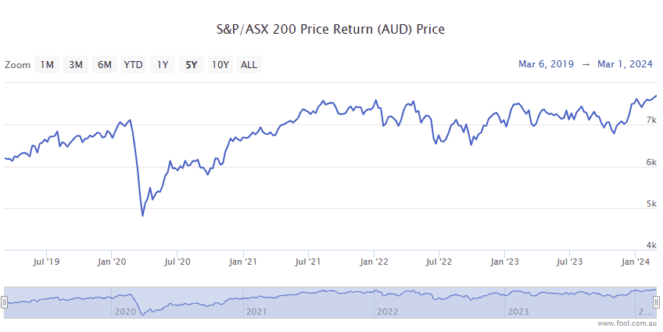

With records meant to be broken, the S&P/ASX 200 Index (ASX: XJO) is certainly doing its part lately.

On Friday, the benchmark Aussie index closed the day up 0.6% at 7,745.6 points. That marked both the highest closing price ever and the highest intraday level ever.

Today, the ASX 200 just edged past that record to set a new one.

In morning trade on Monday, the index of the top 200 listed companies hit 7,754.7 points.

Regardless of what happens in the remainder of the trading day, this marks a new intraday all-time high at time of writing. And if bullish sentiment persists, as I believe is likely, then we should see another record close for the ASX 200 today as well.

Here's what's driving investors to hit the buy button.

Why is the ASX 200 setting fresh records again today?

Momentum in on the bulls' side here as fewer investors are selling and more are looking to buy to get in on the historically strong stock market performance.

Today's new record on the ASX 200 follows the ongoing strength in US markets.

On Friday, both the S&P 500 Index (INDEXSP: .INX) and the tech-laden Nasdaq Composite Index (INDEXNASDAQ: .IXIC) closed at their own new all-time highs.

There are two significant tailwinds buoying investor spirits.

First is the prospect of normalising inflation and an accompanying easing in interest rates ahead. Both would bode well for equities.

Neither the US Federal Reserve nor the Reserve Bank of Australia has committed to any firm dates to cut interest rates yet. But inflation is easing in both countries.

And in the US, the world's biggest economy, a dip in February's manufacturing index bolstered the case for the Fed to begin easing sooner rather than later.

The second phenomenon helping lift US stock markets and the ASX 200 is the growing belief that fast-evolving artificial intelligence (AI) technology could put a rocket under global productivity and growth.

While some analysts are cautioning about a potential AI bubble forming, that hasn't held the likes of NVIDIA Corporation (NASDAQ: NVDA) back.

Shares in the AI hardware and software developer closed up another 4% on Friday. That brings the 12-month gains to 249% and gives the tech giant a market cap of US$2.1 trillion (AU$3.2 trillion).