Did you hear that?

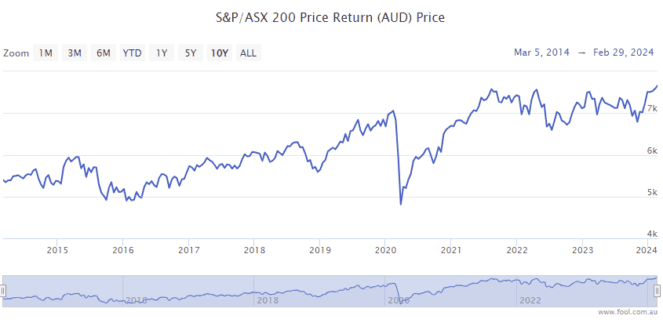

That was the sound of the S&P/ASX 200 Index (ASX: XJO) rocketing into new all-time high territory.

It's the kind of record investors – save short sellers, perhaps – love to see reset.

At the time of writing in morning trade on Friday, the ASX 200 is up 0.3% at 7,718.4 points. That's down from 7,737.4 points just a few minutes ago, which as of now, stands as the new ASX 200 record intraday high.

The prior intraday record was set last month, on 2 February. The ASX 200 reached an intraday high of 7,703.8 points on the day and notched a record closing high of 7,699.4 points.

That means if the benchmark index can maintain its current levels, or rises higher, today will also usher in a new closing high.

And, pleasingly, these records have been resetting fast of late.

The all-time closing high of 7,628.9 points achieved in August 2021, on the other hand, maintained its record spot for two and a half years!

What's sending the ASX 200 into record territory?

There are a number of factors helping drive the benchmark index to new highs.

On the domestic front, we've seen some very solid earnings results from most of the Aussie blue-chip stocks. And with many beating expectations, investors have been hitting the buy button.

The ASX 200 also is catching some tailwinds out of the United States.

Part of this is fuelled by the ongoing AI stock boom, which saw the tech-heavy Nasdaq Composite Index (INDEXSP: .INX) close up 0.9% overnight for its own record closing high.

And part of it comes as inflation in the world's top economy increasingly looks to be coming back to earth.

The personal consumption expenditures (PCE) index data out of the US indicated inflation is still running above the Federal Reserve's target range of 2%. However, it was within economists' consensus expectations. And investors are now upping their bets that the world's most influential central bank could start cutting interest rates as early as June.

Commenting on the US PCE data sending the Nasdaq and ASX 200 to new all-time highs, LPL Financial's Quincy Krosby said (quoted by Bloomberg):

For markets keenly focused on when the Fed will transition towards easing rates, this report will help restore confidence that it isn't 'if' the Fed will begin to cut rates in 2024, but 'when'.