Well, it's another day, another new record high for the S&P/ASX 200 Index (ASX: XJO). Earlier this morning, the ASX 200 hit a new benchmark of 7,768 points. This was also accompanied by a fresh new 52-week high for the Westpac Banking Corp (ASX: WBC) share price.

Yes, Westpac shares also climbed to a new benchmark this morning – $26.54 a share.

This new 52-week high for the ASX 200 bank stock puts the Westpac share price up an impressive 14.86% year to date in 2024, as well as up an even better 19.96% over the past 12 months.

No doubt all Westpac shareholders will be feeling reasonably chuffed right now. But what about investors who have been eyeing Westpac shares to potentially add to their portfolios? Is this bank still worth buying today at new 52-week highs?

Are Westpac shares a buy at this new 52-week high?

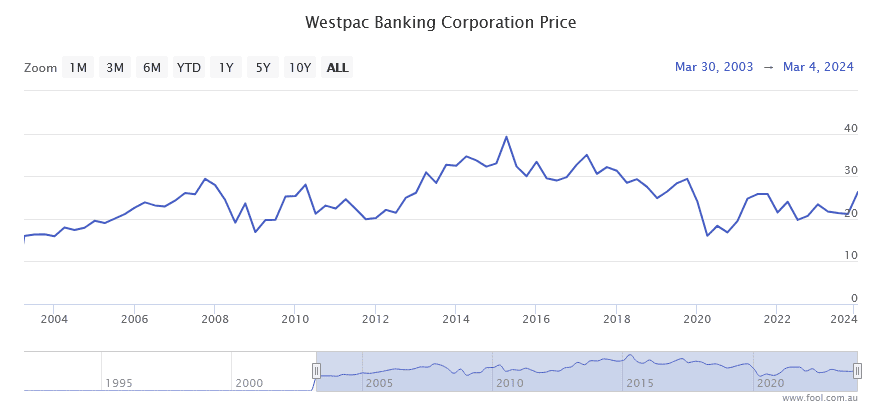

That's an interesting question to ponder. Sure, the past 12 months have been a fantastic time to have owned Westpac stock. But zooming out further, and the picture is very different. Today, at these new 52-week highs, Westpac shares are still not looking expensive by historical standards.

Today's new high merely takes Westpac shares to where they were in June 2021.

Westpac was far more expensive during the final months of 2019 (reaching as high as $30 a share).

In early 2017, we saw it climb as high as $35. And in 2015, the bank was commanding a price close to $40.

Indeed, to find the first time Westpac shares hit $26.50, we'd have to go all the way back to early 2007. If you don't believe me, check it out for yourself below:

As such, we can conclude that Westpac has historically been a fairly poor investment, and unable to compound its earnings effectively over time to increase its valuation.

Given the current banking environment, I don't think that is set to change anytime soon. As such, I don't think Westpac shares are a buy today for anyone who wishes to either match or beat the performance of the ASX 200 Index.

What about the Westpac dividend?

But what about Westpac's generous dividends, you may ask? After all, despite the 52-week high share price, the bank currently trades on a fairly compelling dividend yield of 5.36%. That comes with full franking credits too.

That's objectively a lucrative dividend yield, amongst the best you can get in the upper echelons of the ASX 200.

Whilst I don't think Westpac shares are market-beaters at current pricing, I do think they could be a useful member of a diverse, income-focused portfolio.

I would therefore be happy to call Westpac shares a buy for retirees, income investors and anyone whose primary investing objective is to maximise franked dividend income.

But for anyone else, I think there are better options on the ASX 200 for your money today.