Even though reporting season is now largely done and dusted, there are still plenty of potential catalysts that could rock ASX shares either way.

eToro market analyst Josh Gilbert has picked out the three most critical developments to watch out for this week:

1. Australia GDP

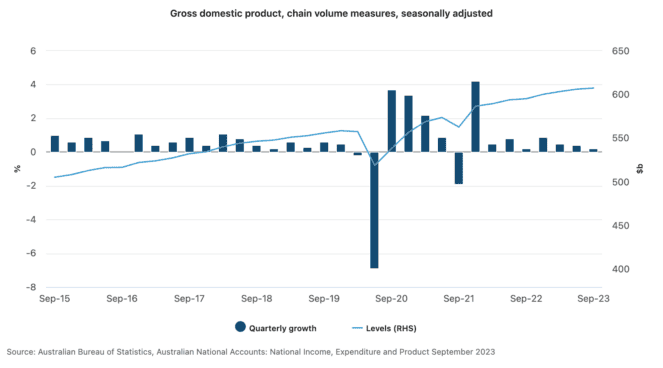

Federal treasurer Jim Chalmers has already predicted Wednesday's numbers would show weak growth for Australian GDP in the December quarter.

"Retail sales in the three months to end 2023 were the early signs that consumers were feeling the impacts of the RBA's tightening cycle, which is likely to be a drag on GDP this week, alongside weaker residential construction," said Gilbert.

"Slowing growth is likely to continue in the Australian economy as consumers continue to reign in spending, as witnessed by retail sales data this week."

This bad news could be good news for investors, as it would push the Reserve Bank closer to deciding that inflation worries have eased, and perhaps a cut in interest rates might be warranted.

The central bank's next decision will come after its meeting on 18 to 19 March.

2. China inflation

As opposed to the Western world, China has been battling deflation over the past year or so.

According to Gilbert, "concerns are escalating" about this week's release of the February CPI data.

"January's figures emphasised the country's economic need for increased support and a surge in demand to avert a deflationary situation, suggesting a more aggressive policy stance is needed."

A liquidation order in January for construction giant Evergrande is emblematic of what the Chinese economy is going through.

source: tradingeconomics.com

"Historically, China's real estate sector has been a substantial driver of the nation's growth, and further distress could ignite fears of a slowdown in China's economic growth.

"It's evident that policymakers need to take more decisive actions as so far, the measures implemented have been substandard, and the lack of improvement in policy stance continues to further dent confidence and hold back spending."

3. Can Bitcoin reach new all-time highs?

Bitcoin (CRYPTO: BTC) has rocketed almost 40% so far this year and 138% going back six months.

Gilbert noted how recently Bitcoin soared as high as US$64,000, which is getting pretty close to the all-time peak of US$69,000 achieved back in 2021.

"Interestingly, this doesn't appear to be a cap, but rather an exciting new beginning for cryptoassets.

"Bitcoin ETFs have piqued interest on a massive scale, with their substantial trading volumes and billions of dollars of inflows highlighting the increasing trend of institutional investors wanting exposure to bitcoin."

Moreover, there are several catalysts coming.

"Upcoming events like the bitcoin halving and mid-year rate cuts, continued inflows into ETFs, and revived retail interest could potentially propel the bull market into six-figure territory."

However, Gilbert urged investors to curb their enthusiasm.

"In this scenario, it's easy for investors to feel FOMO," he said.

"However, it's important to remember your risk profile and understand that bitcoin is still a volatile asset class that has a history of wild price fluctuations."