The Neuren Pharmaceuticals Ltd (ASX: NEU) share price gained 1.1% to close at $19.36 on Thursday despite encountering some turbulence in late afternoon trading.

Most of the gains occurred at the beginning of today's session with the stock rising to an intraday high of $19.70 shortly after the open.

The ASX biotech then released its full-year FY23 report about 25 minutes prior to the market close today.

A small drop in the Neuren share price occurred at the time of the news release, but it quickly steadied.

We will see the full market reaction to the report tomorrow.

In the meantime, let's take a look at the numbers.

Neuren Pharmaceuticals share price steady at market close

Here are the highlights for the full-year FY23:

- Revenue of $231.9 million, up from $14.5 million in FY22

- Profit after tax of $157 million, up from $184,000 in FY22

- Net cash from operating activities of $185 million

- Cash and short-term investments at 31 December 2023 of $228.5 million

- Diluted earnings per share (EPS) of $1.201

Neuren received $231.9 million in revenue after licencing its first drug, Daybue, to US partner Acadia Pharmaceuticals (NASDAQ: ACAD).

This included $59.4 million for the first commercial sales milestone, an upfront $145.7 million under the expanded global licence agreement, and $26.8 million from quarterly royalty income.

Other income included interest income of $5.7 million and foreign exchange gains of $2.4 million.

What else happened in FY23?

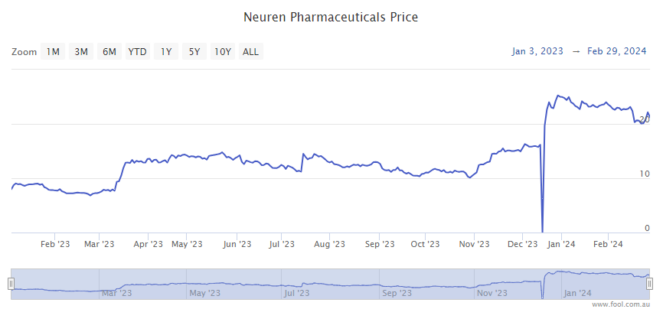

The Neuren Pharmaceuticals share price recorded the strongest growth of any ASX 200 stock in 2023.

Neuren shares ripped up the charts, gaining 214% over the 12 months to 31 December.

Most of that gain came on the back of FDA approval and the initial sales success of Daybue, which is a world-first drug treatment for Rett syndrome.

The Neuren share price surged again in December after the company released top-line results from its Phase 2 clinical trial of NNZ-2591 in children with the debilitating Phelan-McDermid syndrome (PMS).

There are currently no approved treatments for PMS. According to the release, a significant improvement was observed by both clinicians and caregivers from treatment during the trial.

What did management say?

Neuren CEO Jon Pilcher said:

2023 delivered a profit of A$157 million, an exceptional US launch of DAYBUE by Acadia, US$100 million up-front from an expanded partnership with Acadia for trofinetide worldwide and outstanding results from the first clinical trial of NNZ-2591 in patients.

Neuren has never been in a stronger position, with substantial ongoing cash flows and a series of value creating catalysts approaching in 2024.

What's next for Neuren Pharmaceuticals?

Neuren Pharmaceuticals has been under pressure over the past fortnight since a US short-seller released a report describing Daybue as a "flop" amid "horror stories" of side effects among patients.

The short seller's report was released in the US on 15 February, and Neuren issued a response that failed to stop the Neuren Pharmaceuticals share price crashing by 14.2%.

Ahead of today's full-year FY23 report, Arcadia announced 4Q FY23 net sales of Daybue worth US$87.1 million in the US. This was at the top end of the company's guidance range of US$80 million to $87.5 million, following on from net sales of US$67 million in Q3 FY23 and US$23 million in Q2 FY23.

Arcadia also provided full-year 2024 guidance of sales between US$370 million and US$420 million.

However, ASX investors were not pleased and the Neuren Pharmaceuticals share price fell 10.3%.

Neuren Pharmaceuticals share price snapshot

The Neuren Pharmaceuticals share price is down 22% in the year to date.