Brokers are expecting good things from two S&P/ASX 300 Index (ASX: XKO) shares, judging by today's rating and price target upgrades.

A price target is where a broker thinks a share price could be in 12 months from today. The higher the target, the more the brokers expect the company to deliver in terms of share price growth. Of course, there's no guarantee any share price will rise a certain amount in 12 months – it might not rise at all.

Having said that, let's look at two of the ASX 300 shares that brokers are more optimistic about.

Boss Energy Ltd (ASX: BOE)

Broker Bell Potter raised its rating on the energy company to a speculative buy with a price target of $6.34.

At the current Boss Energy share price, that implies a possible rise of around 30% from here.

As reported by my colleague James Mickleboro, Bell Potter said this about the ASX uranium share:

Our valuation is reduced slightly to $6.34/sh (previously $6.41/sh) on changes to our corporate expenditure and associated earnings. With the recent sell-off in BOE we have decided to move to a Speculative Buy (from Speculative Hold) in-line with our ratings structure.

Uranium fundamentals continue to support our thesis being 1) advancement in Nuclear energy across the globe (60 reactors currently under construction) filtering through to a growing demand for U3O8 and 2) a lack of near-term supply as producers exited the market post Fukushima.

The recent acquisition of a 30% interest in the Alta Mesa joint venture, diversifies BOE's operations and revenue streams, making BOE one of only two geographically diversified uranium producers in CY24.

Thanks to a $62.3 million gain on its "investment in uranium and financial assets", Boss Energy was able to report an accounting net profit of $57.6 million in the FY24 first-half result, up from a loss of $2.4 million in the prior corresponding period.

The ASX 300 share also announced it has passed another critical milestone in the development of its Honeymoon project, with the start of commissioning the first ion-exchange circuit within the processing plant. The business added it had seen successful modification and refurbishment of the re-agent systems.

Those achievements mean Honeymoon is now running 24 hours a day, seven days a week, accelerating its push towards production and ramp-up.

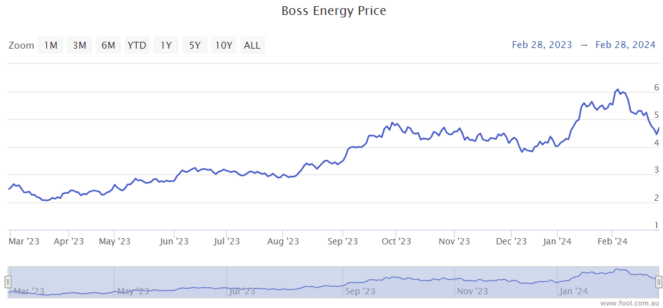

In the past year, the Boss Energy share price has risen by 90%.

APM Human Services International Ltd (ASX: APM)

The broker Jefferies has raised its price target on the ASX 300 share to $1.80. That would be a rise of around 12% from the current APM Human Services International share price.

Yesterday, the business reported its FY24 first-half result and announced it had received an enlarged bid from CVC of $2 per share, which was 25% higher than the $1.60 per share bid.

Jefferies' price target is roughly halfway between the current price and the bid price.

However, there's no guarantee there will be a binding bid submitted, though CVC has been granted a four-week exclusivity period until 27 March 2024. The offer is conditional on several elements, including due diligence, debt financing and regulatory approvals.

Since the start of 2024, the APM share price has risen close to 30%.