Today is shaping up to be busy for APM Human Services International Ltd (ASX: APM) and its share price. Not only has the employment and health services provider handed down its FY24 first-half results, but it's also fielding an updated takeover bid.

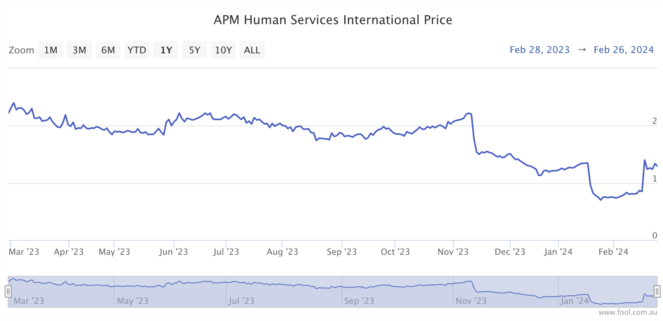

Shares in APM are fetching $1.63 as we approach the end of the trading day, up 15.6%. The upward move means the company's share price is now 33% below its 52-week high.

Boosted bid catapults APM share price

If shareholders were concerned about first-half figures, the increased non-binding offer from CBC Asia Pacific Limited has provided a backstop, taking the pressure off today's results.

Nonetheless, here are the important numbers from the release:

- Revenue up 31% on the prior corresponding period to $1,116.8 million

- Underlying EBITDA down 12% to $147.8 million

- Statutory net profit after tax and amortisation (NPATA) down 41% to $43.6 million

- Diluted earnings per share (EPS) of 1.8 cents per share, down from 5.5

- Dividend determination postponed until financial year-end

According to the release, the board has opted to defer a dividend amid the proposed bid from CVC. However, the existing policy of paying out 40% to 60% of NPATA still stands.

What else happened during the half?

For the six months ended 31 December 2023, APM experienced a soft market for its services in Australia and New Zealand (ANZ) and its 'Rest of World' geographies. The ANZ region saw its top line grow 9% to $$24.6 million while underlying NPATA fell 61% to $17.3 million.

The company's saving grace was its North American operations, benefitting from Equus's full integration and inclusion. As a result, revenue more than doubled (119%) to $494 million versus the prior corresponding period, becoming the largest source of revenue.

Australia's prolonged low unemployment rate was listed as a drag on the region's earnings in the half. The situation has stemmed the flow of clients into APM's employment services, suppressing performance-based income.

On 18 January 2024, the APM share price plunged 41% after delivering its first-half trading update. Shares have since been on a recovery amid takeover interest from private equity firm CVC.

What did management say?

AMP Group CEO Michael Anghie touched on the difficult set of conditions the company is facing, stating:

As previously stated, we have been operating in an environment with extended and historic low levels of unemployment which has impacted client flows and the intensity of support required to be provided for those clients in programs.

Adding,

Whilst we are seeing early signs of stabilisation in unemployment data and caseloads in employment programs, the current environment remains subdued.

The road ahead for APM

APM reiterated its previously advised guidance regarding what the next half could look like. EBITDA and NPATA in the second half are expected to be higher than the first. Management believes North American operations will contribute more as contracts 'mature'.

Elsewhere, the next steps on CVC's revised proposed bid will be in the spotlight. Today, the private equity firm stepped up its offer to $2.00 per share, representing a 25% increase from its previous $1.60 bid.

CVC has been granted a four-week exclusivity period until 27 March 2024. Furthermore, the offer is conditional on several matters, including due diligence, debt financing, and regulatory approvals.

The APM share price is down 30% over the past year.