The Motley Fool always recommends investors tread carefully with ASX shares that have a massive dividend yield.

After all, the yield could have become sky-high because the stock price has nosedived. The business could be suffering or its industry is in strife.

That is, there is not much point in harvesting a 20% dividend yield if the stock price halves.

Having said that, if you have an immediate goal of nabbing $1,000 of passive income from just a $10,000 outlay, there are some options.

Check this out:

Huge dividend producer

East coast coal miner Yancoal Australia Ltd (ASX: YAL) has an admirable recent record of handing out huge dividends.

The company released its 2023 full-year result on Friday night, which showed revenue had come down from $10.5 billion to $7.8 billion.

The drop was attributed to a 39% fall in the realised coal price, which cancelled out a 14% surge in attributable saleable coal production during the year.

Chief executive David Moult seemed to be happy with the direction of the business.

"In the second half, attributable saleable coal production jumped 32% and cash operating costs fell 21%," he said.

"We expect to carry this operational momentum into 2024. Production volumes will vary each quarter, with higher output (and resulting lower unit costs) likely in the second half."

A grand of passive income

The wash-up of all this was that Yancoal announced a dividend of 32.5 cents per share.

That means that when that's paid on 30 April, the dividend yield will be around 12.5% based on the current share price.

So buying Yancoal shares now with the $10,000 could deliver you $1,250 within a year.

Of course, the fortunes of an energy stock such as this are highly dependent on how global commodity prices fluctuate.

At least for now, both analysts covering Yancoal believe it's a strong buy, according to CMC Invest.

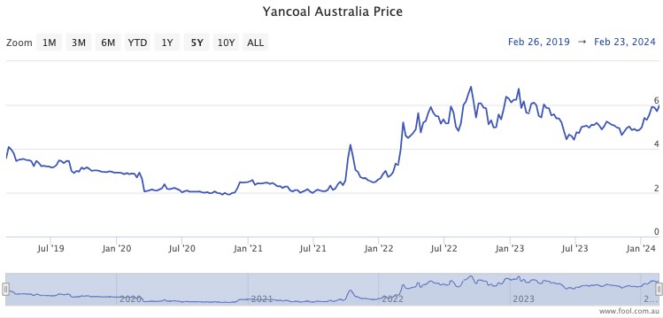

The Yancoal share price is up 35% over the past five years.