The S&P/ASX 300 Index (ASX: XKO) is down 0.3% during the Tuesday lunch hour, but we certainly can't blame this ASX 300 stock for those losses.

Shares in the Aussie childcare centre operator are up a whopping 13.8% at the time of writing, trading for $1.275 apiece.

Any guesses?

If you said G8 Education Ltd (ASX: GEM), go to the head of the virtual class.

The ASX 300 stock is soaring today as investors mull over the company's full-year 2023 results.

Read on for the highlights for G8 Education as well as for another ASX education stock.

ASX 300 stock leaps on 2023 profit boost

- Revenue of $983 million, up 9.1% from 2022

- Statutory net profit after tax (NPAT) of $56 million, up 53.1% year on year

- Operating earnings before interest and tax (EBIT) up 25.2% from 2022 to $101 million

- Fully franked dividend of 3 cents per share, up from 2 cents per share in 2022

What else happened with G8 Education during the year?

The 53% increase in NPAT that looks to be sending the ASX 300 share rocketing today was attributed to G8's earnings recovery. This was driven by improved centre performance, well-managed support office costs and lower net finance costs.

Occupancy levels slipped slightly from 2022 to 70.4% (down from 70.6%). But management noted this had stabilised in the second half of 2023, offering a positive start to 2024.

G8 Education also highlighted that 90% of its long day care centres are now rated as 'exceeding' or 'meeting' the National Quality Standard.

The 3 cents per share final dividend takes the company's full-year passive income payout to 4.5 cents per share, up 50% from 2022. At the current share price that equates to a fully franked yield (partly trailing, partly pending) of 3.5%.

What did management say?

Commenting on the results sending the ASX 300 stock sharply higher today, G8 Education CEO Pejman Okhovat said:

Our team's effort in 2023 saw G8 Education continue to improve its financial performance by focusing on improving experiences for its families and employees, while maintaining a disciplined approach to running our business, optimising our network, and carefully managing costs and our balance sheet.

At our Strategy Day in late 2023, we announced a program of network optimisation to improve group performance. I'm pleased to report we have completed eight of the targeted 31 divestments with another tranche of eight with in-principal agreements.

What's next for the ASX 300 stock?

Looking at what could impact the ASX 300 stock in the year ahead, G8 reported that spot occupancy for the week ending 25 February was 66.3%, 1.7% higher than in 2023.

G8 increased fees by 4.5% in January to alleviate ongoing inflationary pressures. Management said the company's capital allocation framework "supports strong cashflow". 2024 capex is estimated to be $40 million to $45 million.

G8 Education share price snapshot

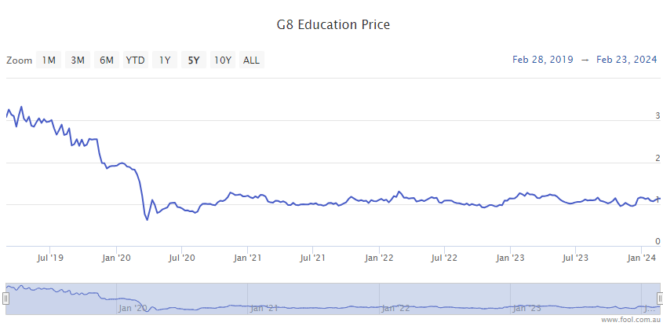

With today's big boost factored in, the G8 Education share price is up 5% over the past 12 months, not including the dividend payouts.

The ASX 300 stock is up 37% from the recent 7 December lows.

Another ASX education stock leaping higher on results!

Although not an ASX 300 stock, Keypath Education International Inc (ASX: KED) is another ASX education stock that's handsomely rewarding shareholders today.

The Keypath share price is up 17% at the time of writing, with shares trading for 55 cents apiece.

This follows on the company's half-year results for the six months ending 31 December (1H FY 2024).

Keypath Education shares leap on revenue boost

- Revenue of US$66.9 million, up 14.0% from H1 FY 2023 (up 15.3% on a constant currency basis)

- Adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) of US$2.3 million, US$9.1 million higher than H1 FY 2023

- Net position of US$41.7 million, with no debt, as at 31 December

- Keypath FY 2024 revenue guidance in upper end of range of US$130 million to US$135 million