The Suncorp Group Ltd (ASX: SUN) share price is charging ahead today.

Shares in the S&P/ASX 200 Index (ASX: XJO) banking and insurance company closed Friday trading for $15.13. In early trade on Monday, shares are swapping hands for $15.49 apiece, up 2.4%.

For some context, the ASX 200 is up 0.4% at this same time.

This comes following the release of Suncorp's half-year results for the six months ending 31 December (1H FY2024).

Here are the highlights.

Suncorp share price lifts on profit boost

- Cash earnings of $660 million, up 13.8% from 1H FY2023

- Net profit after tax (NPAT) of $582 million, up 5.4% year on year

- Net investment income of $396 million, up 137% from 1H FY2023

- Fully franked interim dividend of 34 cents per share, up from 33 cents per share

What else happened with Suncorp during the half year?

Perhaps the biggest event, which occurred after the end of the half year, was the 20 February decision by the Australian Competition Tribunal greenlighting the proposed sale of Suncorp Bank to ANZ Group Holdings Ltd (ASX: ANZ).

The deal is still awaiting final approval from the Queensland government and the Federal Treasurers. But Suncorp reported it still expects ANZ's acquisition of its banking arm to complete around the middle of 2024.

Suncorp expects net proceeds of $4.1 billion from the sale. Management said they remain "committed to returning to shareholders any capital that is excess to the needs of the business following completion".

The Suncorp share price gained on the 20 February news, while ANZ shares hit some headwinds.

That could be because the banking sector, more broadly, is coming under some pressure. Suncorp Bank is no exception, with its net interest margin (NIM) dropping from 2.03% in 1H FY 2023 to 1.80% in the half year just past. Costs were up too, with a cost to income ratio of 58.4%, up from 49.9% a year ago. Suncorp Bank profit after tax of $192 million was down 25.0%.

On the insurance front, Suncorp reported gross written premium (GWP) growth of 16.3% in its General Insurance business. The company said this reflected customer growth and price increases driven by increasing reinsurance costs, elevated natural hazard experience and ongoing inflationary pressures.

The total cost of natural hazard events came in $112 million below Suncorp's allowance for the half year at $568 million.

What did management say?

Commenting on the results sending the Suncorp share price higher today, CEO Steve Johnston noted it was a challenging six months amid ongoing inflationary pressures and six severe weather events in Australia in November and December.

Against this backdrop, the group has continued to work hard to support its customers while also delivering improved earnings driven by increased customer demand for our products and services and positive investment performance over the half.

Net investment returns were up significantly from $167 million in 1H23 to $396 million, and this has been a key contributor to our reported earnings and profit for the half.

On the Australian Competition Tribunal's decision to authorise the sale of Suncorp Bank to ANZ, he added, "The decision brings us one step closer to becoming a dedicated Trans-Tasman insurer proudly headquartered in Queensland."

What's next?

Looking at what could impact the Suncorp share price in the months ahead, the company forecasts GWP growth in the low to mid-teens for FY 2024.

On the cost front, the company expects expense ratios in the second half similar to the first half. This also reflects ongoing investment in growing its business.

And there's the pending completion of the sale of Suncorp Bank to ANZ, expected mid-year.

Suncorp share price snapshot

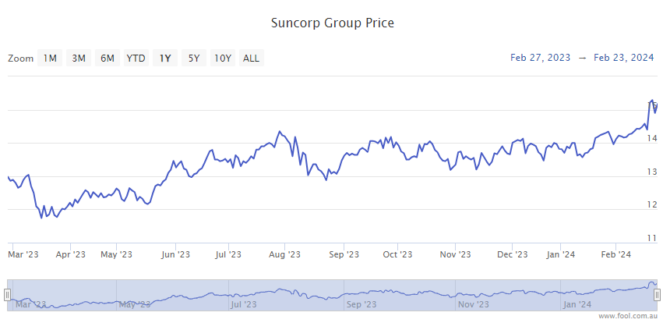

The Suncorp share price is up 20% in 12 months, not including the two dividend payouts.