Starting from just a modest amount, anyone can build an ASX stock portfolio to fatten up for a significant flow of passive income later.

Just $20,000, which is about half the savings that the average Australian has, can get you started.

I reckon, eventually, you could sit back and watch an average of $25,000 every year land in your bank account.

It's all possible using the power of compounding.

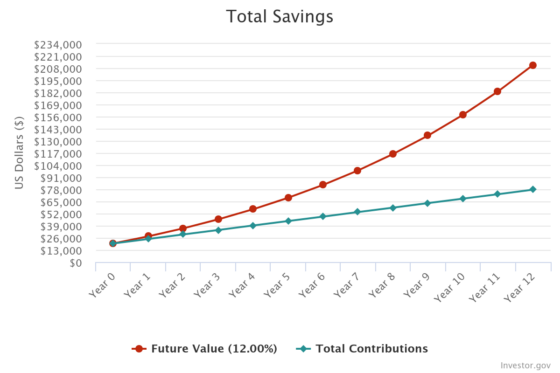

Check this out:

Invest and keep adding to it

Let's hypothetically assume you can build a portfolio with that $20,000 that can, over the long term, average a compound annual growth rate (CAGR) of 12%.

I contend that this is reasonable, with diligent research and stock selection.

Quality businesses like Johns Lyng Group Ltd (ASX: JLG) and Lovisa Holdings Ltd (ASX: LOV) have managed to return 40.6% and 23.3% per annum over the past five years.

So with a mixture of those sorts of winners, some neutrals and the inevitable losers, there's no reason why your $20,000 can't grow at 12% a year.

Just practise sensible diversification, and act on sensible advice.

But it's not just about investing and then forgetting about it.

Big rewards only come with hard work, and you need to keep saving and adding to this investment.

Assuming that you can afford to add $400 a month, after 12 years of monthly compounding, the nest egg will have grown to $211,436.

Passive income after 12 years of 12%

Now let's have some fun.

From the 13th year, sell off the 12% gains each year.

That will provide you with an annual passive income of $25,372.

Mission accomplished.

Of course, the share market can be volatile, so you won't receive this much every single year.

In some years, the passive income will be far less. In others, it will be much more.

But if you maintain a portfolio with a 12% CAGR, over the long run the cash flow will average out to $25,372.

The moral of the story is that regardless of how much you can afford to put in, start investing.

You can't buy time, but it's such an important ingredient.