Three S&P/ASX 200 Index (ASX: XJO) shares just earned substantial upgrades from leading brokers.

The bullish broker outlooks for these stocks follow the release of the companies' earnings results.

The brokers forecast these big-name ASX stocks could see share price gains of as much as 25% over the year ahead. And that's not including the dividends all three companies pay.

Read on for the three stocks with some big potential gains ahead.

(Broker data courtesy of The Australian.)

Why these three ASX 200 shares could surge in 2024

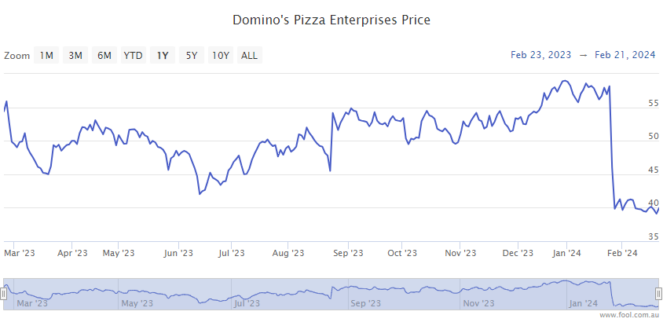

The first ASX 200 share earning a broker upgrade is Domino's Pizza Enterprises Ltd (ASX: DMP).

The fast-food pizza retailer reported its half-year results on Wednesday. The Domino's share price closed up 2.7% on the day and gained another 7.7% yesterday. Shares are up 0.4% in early afternoon trade today at $43.85 apiece.

On the positive side of the ledger, network sales increased 8.8% year on year to $2.14 billion. And Domino's reported same store sales growth of 1.25%. This came alongside an 11.8% boost in online sales, which reached $1.71 billion over the six months.

On the negative side of the ledger for the ASX 200 share, earnings before interest and tax (EBIT) was down 5.3% to $107.9 million. And net profit after tax (NPAT) was down 13% to $62.3 million. Earnings and profits were both impacted by the company's struggling Asian operations.

Still, 2024 is off to a strong start.

In the first seven weeks of the new half, same stores sales growth increased 8.39% in ANZ and 0.34% in Asia. Growth dipped 0.64% in Europe.

Even after the past three days of share price gains, Jarden Securities sees significant further upside ahead.

The broker raised Domino's to an 'overweight' rating with a $49 price target. That's almost 12% above current levels. And that's not including dividends. Domino's declared an unfranked interim dividend of 55.5 cents per share.

Which brings us to the second ASX 200 share receiving a significant broker upgrade, fashion jewellery retailer Lovisa Holdings Ltd (ASX: LOV).

Lovisa reported its half-year results on Thursday. Investors reacted by sending the stock up 10.4%. And the Lovisa share price is up another 4.8% in afternoon trade on Friday at $28.62.

Investor enthusiasm was stoked by the company's opening 74 new outlets over the six months. Lovisa had 854 stores at the end of December. In a major development, the company opened its first stores in China and Vietnam.

On the financial front, revenue increased 18.2% year on year to $373 million, with NPAT up 12.0% to $53.5 million.

Citi noted that "Lovisa has delivered another strong result and is successfully evolving into a global retailer".

The broker raised Lovisa to a 'buy' rating with a $31.65 price target. That represents a potential upside of more than 10% from current levels. Lovisa also pays dividends. The company declared an interim dividend 50 cents per share, 30% franked.

Rounding off the list

Rounding off the list of ASX 200 shares receiving hefty broker upgrades is gambling and gaming company Tabcorp Holdings Ltd (ASX: TAH).

Tabcorp reported its half-year results on Thursday.

The company reported a statutory net loss after tax of $636.8 million for the six months. And revenue was down 5% year on year to $1.21 billion.

Concerned over the sliding revenues, investors hit the sell button yesterday, sending the Tabcorp share price down 10.3%. But the buyers are back on Friday, with Tabcorp shares up 4.2% at the time of writing, trading for 68 cents apiece.

It's unlikely today's buying is fuelled by the 1 cent per share, fully franked interim dividend.

But the fact that this represents a payout ratio of 111%, which management said reflected "confidence in the business and a strong financial position", could be stirring optimism.

As could the ASX 200 share's ongoing investments in AI and new technology platforms, which management said was enabling the company to become a more digital-oriented business.

Macquarie certainly has a bullish outlook for the stock. The broker raised Tabcorp to an 'outperform' rating with an 85-cent price target.

That represents a 25% potential upside from current levels.