The ASX is fortunate enough to host many quality stocks that offer high dividend yields by international standards.

That's no accident.

Australia's rules that allow investors to reduce their income tax liability if the company has already paid corporate tax on dividends encourages this situation.

So which are some of the bargains offering more than 8% yield at the moment?

Here are two that have caught my eye:

40% discount to what the assets are worth

Growthpoint Properties Australia Ltd (ASX: GOZ), which is a real estate investment trust (REIT) that owns industrial and office properties, reported its latest results on Thursday.

High interest rates and the uncertainty in workers returning to the office are admittedly keeping the stock down, having lost 28.4% over the past year.

But that gives it plenty of cyclical upside. The stock is now trading at an almost 40% discount to its net tangible assets.

So buying Growthpoint shares now means you're effectively becoming a landlord for far cheaper than if you bought those properties directly.

The depressed valuation also provides those willing to dive in now with a sensational dividend yield.

After Thursday's announcement of a 9.65 cent distribution per share, the total payout for the last 12 months becomes 20.35 cents.

That equates to a yield of 8.85%.

A cheap stock paying 11% yield

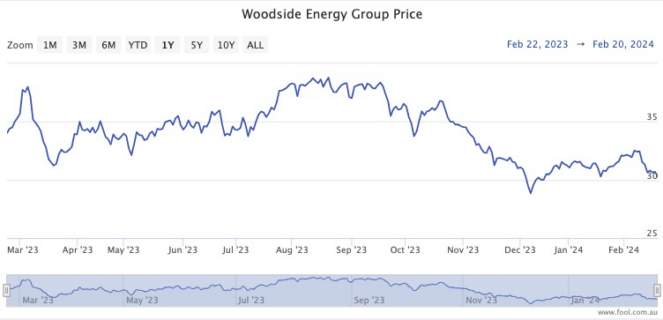

A riskier proposition, but potentially more rewarding, is Woodside Energy Group Ltd (ASX: WDS).

After a 12.2% drop in the share price over the past year, Woodside's dividend yield now stands at a monstrous 11.1%.

Of course, the caveat here is that the fortunes for an ASX energy stock like Woodside is highly dependent on global oil prices.

If that plunges over the next year then the company may reduce the dividend.

Conversely, if the global crude prices rise then both the Woodside stock price and distribution payments could rocket.

A survey of professional investors on CMC Invest suggests many are comfortable with buying Woodside shares right now.

Eight out of 15 analysts rate the energy stock as a buy, while only three recommend selling.