The WiseTech Global Ltd (ASX: WTC) share price is charging higher today.

Shares in the S&P/ASX 200 Index (ASX: XJO) tech stock closed yesterday trading for $79.85. In morning trade on Wednesday, shares are swapping hands for $86.50, up 8.3%.

For some context, the ASX 200 is down 0.5% at this same time.

This follows the release of WiseTech's half-year financial results for the six months ending 31 December (1H 2024).

WiseTech share price leaps on earnings boost

- Revenue of $500 million, up 32% from 1H 2023

- Earnings before interest, taxes, depreciation and amortisation (EBITDA) of 230 million, up 23% year on year

- Underlying net profit after tax (NPAT) of $128 million, up 5% from 1H 2023

- Interim fully franked dividend of 7.7 cents per share, up 17%

What else happened during the first half for WiseTech?

One of the biggest events during the half-year was WiseTech's acquisition of MatchBox Exchange in October. The company notes this has further enhanced its CargoWise Landside Logistics.

And the WiseTech share price may be getting a boost from the 40% year on year increase in CargoWise revenue, which reached $421 million for the six months. This was driven by recent M&A as well as customer growth, including new Large Global Freight Forwarder (LGFF) rollouts.

In other strong financial metrics, the EBITDA margin of 46% came in ahead of expectations.

And the company reported a 13% increase in free cash flow from the prior corresponding half-year to $155 million.

As at 31 December, WiseTech had a total liquidity of $445 million from cash and undrawn debt facilities.

And the logistics software provider boosted its R&D investments by 54% year on year to $178 million, or 35% of total revenue. This helped deliver 576 new product enhancements over the six months.

On the cost front, WiseTech's efficiency program was reported to be on track to deliver $15 million in net savings in FY24. The company is aiming for $40 million in annual savings.

What did management say?

Commenting on the results lifting WiseTech share price today, CEO Richard White said:

We continue to focus on enhancing our core CargoWise platform in pursuit of our vision to be the operating system for global logistics. Innovation remains a critical driver of our growth.

We have increased our investment in research and development over the last five years, investing over $1 billion to deliver more than 5,500 product enhancements which creates substantial value for our customers and underpins revenue growth…

Adding to our list of Top 25 Global Freight Forwarders, we have secured a CargoWise global rollout with Sinotrans, bringing our penetration of the Top 25 Global Freight Forwarders to 13, which is more than half of the Top 25. We also secured large global freight forwarder rollouts with APL Logistics and Yamato Transport, taking us to 49 LGFFs overall.

What's next?

Looking at what might impact the WiseTech share price in the months ahead, the company reaffirmed its FY 2024 guidance range for revenue of $1.04 billion to $1.10 billion, an annual growth rate of 27% to 34%.

FY 2024 EBITDA is forecast to be in the range of $455 million to $490 million, with an annual growth rate of 18% to 27%.

And WiseTech lifted its full year EBITDA margin guidance range to between 44% and 46%, following on the EBITDA margin strength of the half year just past.

"Our highly cash-generative business model and strong liquidity continue to provide a solid platform to fund long-term sustainable growth," White said.

WiseTech share price snapshot

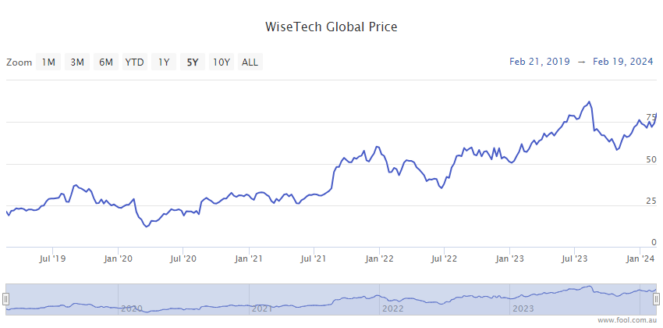

The WiseTech share price is up 55% in 12 months.

So far, in 2024, the ASX 200 tech stock has gained 13%.