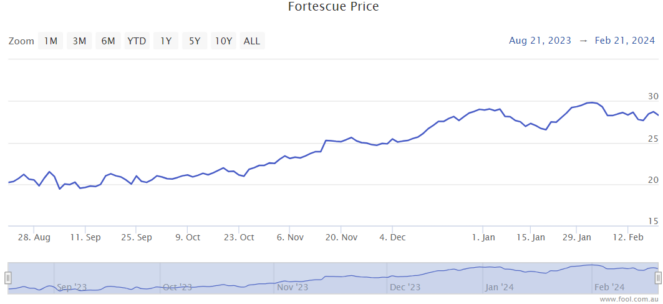

The Fortescue Metals Group Ltd (ASX: FMG) share price has dropped 10% since the end of January. Some investors may be wondering whether this is the right time to invest.

Indeed, the share prices of BHP Group Ltd (ASX: BHP) and Rio Tinto Ltd (ASX: RIO) have both fallen in February 2024 as well, with each ASX mining share dropping by at least 5% this month.

What's going on with the iron ore price?

It's understandable why there is volatility in the market for some miners. The iron ore price has seen a sizeable fall – according to Trading Economics it's now down to US$124.50 per tonne, after starting the month at around US$133 per tonne.

The current price still leaves plenty of room for Fortescue and the other ASX iron ore shares to make large profits, but it does cut into profitability.

Remember, mining costs don't usually change much each month, so extra revenue dollars from a higher commodity price largely translate into extra net profit (before tax) dollars on that production. But, the reverse is true when the iron ore price falls – it largely cuts into net profit.

Making good profits is usually what investors focus on, so a fall in potential monthly profits is going to have an impact.

Is it time to buy Fortescue shares?

The Fortescue share price is down more than 3% today. But, it's still up by more than 30% in the last six months.

I think this business is one of the best in the world at what it does, with low operating costs and a compelling future in green hydrogen, green ammonia and industrial batteries.

I'm a long-term Fortescue shareholder and I believe in the company's future.

However, I'm also a believer that iron ore is a very cyclical commodity. There's no rule that says when the iron ore price will go higher or lower, it's very unpredictable. We don't know when Chinese demand will increase or decrease.

I don't think it makes sense to invest (much) when the iron ore price is above US$120 per tonne. Within the last 12 months, the iron ore price has been below US$100 per tonne.

I'd suggest being patient and waiting for a time when the iron ore price is lower, which I believe will send the Fortescue share price lower, as we've seen over the past few weeks.

The dividend yield could be appealing though. According to the projection on Commsec, Fortescue could pay a grossed-up dividend yield of 11.25% in FY24. But, it wouldn't be helpful for new investors if the Fortescue share price fell by more than that.