The Fortescue Metals Group Ltd (ASX: FMG) share price is currently slightly down even though other ASX iron ore share peers have seen gains and there has been a positive green hydrogen update. For example, the BHP Group Ltd (ASX: BHP) share price is up 0.3% and the Rio Tinto Ltd (ASX: RIO) share price is up 0.7%.

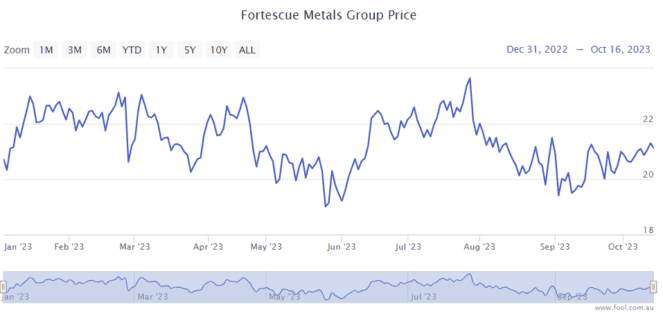

As we can see on the chart below, it has been a volatile period in 2023 to date, though the ASX mining share is up 5%.

Green hydrogen update

The company announced that it has been selected to begin award negotiations as part of the US Department of Energy Office of Clean Energy Demonstrations (OCED) development of the Pacific Northwest Hydrogen Hub, which in total is estimated to receive up to $1 billion on Bipartisan Infrastructure Law funding.

According to reporting by The Australian, the resources business is in line to receive a subsidy of "up to US$150 million", or A$238 million in Australian dollar terms.

This comes after the recent energy purchase agreement with Genex Power Ltd (ASX: GNX).

Fortescue said this enables it to work in partnership to establish the Pacific Northwest Hydrogen Hub, which includes Fortescue's proposed green hydrogen production facility in Centralia, Washington State.

The OCED will help with planning, detailed design, environmental permitting, and procurement of long-lead equipment.

This project in Centralia is planned to be sited on a "remediated" coal mine adjacent to Washington's last coal-fired power plant, which is scheduled to be permanently retired in 2025.

This facility will produce green hydrogen "at scale" for use locally in the Pacific Northwest in heavy-duty transportation, grid reliability, maritime, industrial processes, and other hard-to-abate sectors.

The company note it will create high-paying jobs for the local workforce, create a new 'economic engine' for Lewis County, and provide regional clean energy benefits.

Project construction is expected to start in 2026 and continue into 2028, subject to a final investment decision by the Fortescue board. Once complete and producing green hydrogen, it could help support the Fortescue share price.

Andrew Forrest comments

The Fortescue figurehead Andrew Forrest said:

There is no place better in the world to be investing in renewable and green energy projects right now than the United States.

Federal funding like this, alongside other incentives in the Inflation Reduction Act, go a long way to helping reduce risk and accelerate the widespread production of green hydrogen. In turn, this will catalyse substantial private sector investment, creating new good-paying jobs and economic prosperity for Americans, particularly those in economically vulnerable communities in the Pacific Northwest.

Fortescue share price snapshot

Over the past 12 months, the Fortescue share price has gone up by more than 25% and paid a sizeable dividend as well.