Lovisa Holdings Ltd (ASX: LOV) is in select company on the ASX in that it can be considered both a growth and dividend stock.

The share price has now returned a whopping 164% over the past five years, and just a few weeks ago in late November the dividend yield was up at 3.8%.

The stock price has rocketed 42% since then so the yield has admittedly moderated to 2.6%. Nevertheless, the jewellery retailer has a consistent history of paying out in recent years.

Now, what if I told you that you could earn a passive income of $10,000 each year using Lovisa shares?

Outstanding ASX stock with explosive compounding

Of course, The Motley Fool always encourages investors to diversify their portfolios to reduce risk.

So this single stock example is to demonstrate the wealth-building power of ASX shares through compounding, rather than to prompt you to put all your money in Lovisa.

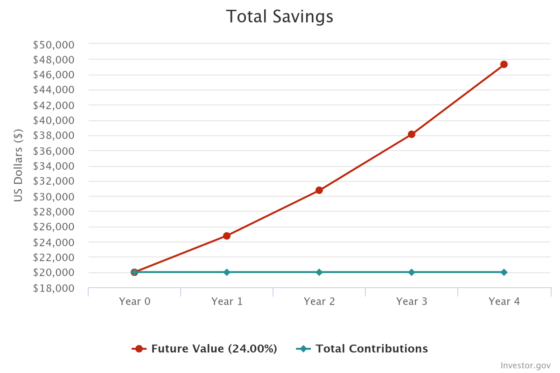

Let's assume you had $20,000 to start with, which is reportedly about half the average level of savings for an Australian.

That will buy you around 782 Lovisa shares at the moment.

Over the last five years, the retailer stock has averaged a compound annual growth rate (CAGR) of 21.4%, excluding dividends.

If we add the current 2.6% dividend yield to that, the yearly growth rate becomes 24%.

A handful of shares + time = passive income

Check out how awesome your 782 shares could do if you reinvested all those returns each year.

After just four years, the pot will have grown to $47,284.

From then on, if you stop reinvesting the annual returns and start cashing it in instead, you have yourself a handy five-digit passive income.

That's $11,348, to be precise.

Just 782 Lovisa shares and 48 months. That's all it took.

Notwithstanding the sharp run-up in the stock price, Lovisa is still well-liked among professional investors.

Broking platform CMC Invest currently shows eight out of 13 analysts recommending the retail stock as a buy.