The rise of ASX uranium shares like Paladin Energy Ltd (ASX: PDN) has been one of the biggest and most notable trends on the ASX in recent months.

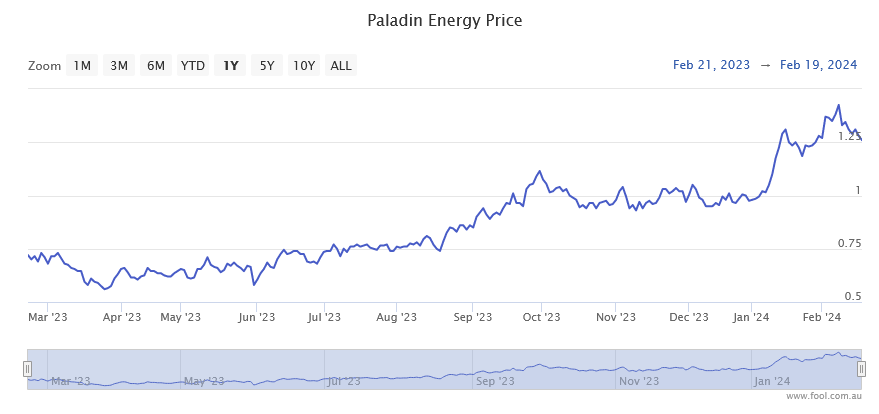

Take the Paladin share price. In May 2023, this uranium stock hit a new 52-week low of 52 cents a share. But earlier this month, those same shares hit a new high of $1.46, a gain worth just over 180% from that 52-week low.

Since then, Paladin shares have cooled off a little, but are still going for $1.18 at the time of writing. See for yourself below:

We've seen similar gains with other ASX uranium shares too. Boss Energy Ltd (ASX: BOE) shares, for example, shot up more than 200% between March 2023 and early February 2024.

After these stunning gains in the ASX uranium space, some investors might be wondering just how much gas is left in the uranium tank.

Well, one ASX expert thinks uranium shares, and Paladin Energy in particular, are well-positioned to surge even higher from here.

Why this ASX expert reckons Paladin shares aren't done yet

Paladin shares are one of the current holdings in the Blackwattle Small Cap Quality Fund. In this managed fund's January update for 2024, portfolio managers Robert Hawkesford and Daniel Broeren named Paladin as one of the fund's largest contributors to its recent performance.

Here's some of what they said on their outlook for this ASX uranium stock:

Paladin Energy had a strong January, led by a rapid increase in the uranium price outlook. The market for uranium remains in a significant deficit and is expected to remain that way for the rest of the decade.

This places re-start projects like Paladin in a great position to capitalise on the high prices that are needed to incentivise additional supply to enter the market.

Of course, Blackwattle isn't the only fund that's bullish on uranium shares like Paladin. Back on Valentine's Day, we also covered the views of Eiger Capital. Eiger cited the appeal of nuclear energy during the world's transition to net zero emissions of carbon dioxide for their view. Here's what they told investors:

We continue to believe that nuclear energy will play an increasingly important role in providing the world with clean power and maintain significant positions in near-term uranium producers, Boss Energy and Paladin Energy.

So no doubt investors of Paladin Energy and other uranium shares will draw great comfort from these bullish appraisals. Let's see how it plays out.