The window of opportunity to snag the latest Wesfarmers Ltd (ASX: WES) dividend is shut.

After declaring its latest interim dividend on Thursday last week, the final day of eligibility for the retail conglomerate's payment was yesterday. Now trading ex-dividend, any purchasing settlements of Wesfarmers shares occurring today will miss out.

Shares in the $71 billion behemoth are 1.5% lower at $63.00 apiece this morning.

Here's what new investors are missing out on

The owner of Kmart, Bunnings, and Officeworks delivered a solid half-year result last week despite tough conditions for retailers amid exceptionally high interest rates.

Many other ASX-listed retail shares have unveiled declining profits during this reporting season. However, Wesfarmers dished out a respectable 3% increase in net profits after tax (NPAT) to $1.43 billion.

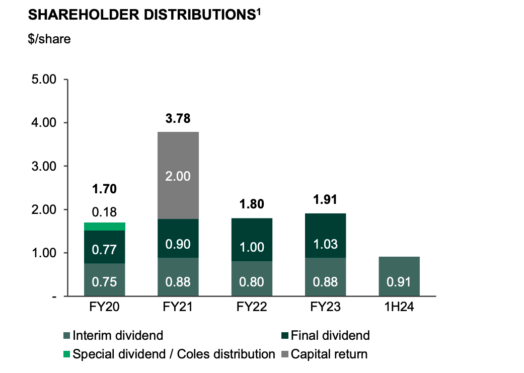

Buoyed by stronger earnings, Wesfarmers has boosted its fully franked interim dividend by 3.4% to 91 cents per share. The payment to shareholders will mark the largest interim dividend since April 2019, when the company maintained some ownership in Coles Group Ltd (ASX: COL).

If we look at the dividends over the past 12 months, shareholders have accrued $1.94 of income per share. This translates to a dividend yield of 3.08% based on the Wesfarmers share price at the time of writing.

Simply put, a $10,000 holding in Wesfarmers would have amounted to $308 worth of passive income from these two payouts. After franking, or what's referred to as 'gross dividends', the figure improves to approximately $440.

Those eligible to receive Wesfarmers' interim dividend will see it appear on 27 March 2024.

Could Wesfarmers shares still be a buy for income?

The window is shut on Wesfarmers' interim dividend, but is it too late to buy for future passive tendies?

Analysts at investment bank Jefferies would suggest possibly not. Impressed by the result amid challenging cost inflation, the analysts bumped their Wesfarmers share price target from $57.00 to $60.00.

Furthermore, full-year earnings are expected to hit $2.53 billion in FY24 and $2.76 billion in FY25. For reference, the company raked in $2.465 billion in profits in FY23.

If this were to occur, shareholders could see dividends continue to grow over the coming years.