It's all happening in the land of ASX shares as reporting season ploughs ahead in earnest.

eToro market analyst Josh Gilbert has picked out the three critical developments to watch this week:

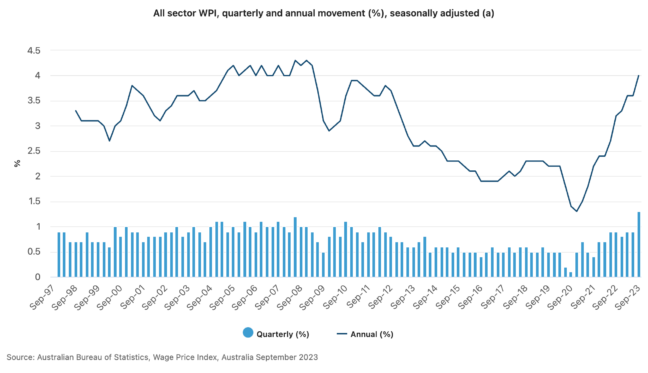

1. Australian quarterly wage index

Wednesday will see the latest wage statistics, which will be crucial in determining which direction the Reserve Bank of Australia will go with interest rates.

According to Gilbert, the wage index is expected to rise 1% quarter-on-quarter and to 4.1% year-on-year.

"With capacity in Australia's job market growing, wages should not see too much pressure to the upside from here, given that we will likely see the unemployment rate grow during 2024, all of which is good news for inflation."

He added that the signs have been positive for a peak in rates.

"Unemployment last week [lifted] more than expected, showing the labour market is loosening.

"Rising unemployment will be a significant reason for the RBA to cut rates, with market pricing looking to as early as June for the first cut."

2. Pilbara Minerals results

There is no getting around the fact that ASX lithium shares have backed up their horrible 2023 with more losses in 2024.

"It's been a torrid few years for the price of lithium as it continues to freefall, weighing heavily on local miners that enjoyed a strong 2022 during peak prices for the asset."

Pilbara Minerals Ltd (ASX: PLS), which reports on Thursday, has been more resilient than others, only losing 6.9% so far this year.

"That's because it has a better balance sheet than most to get it through this lithium winter, allowing it to continue expanding and growing production."

It's obvious income will plunge in the coming results, so Gilbert advises investors to focus on the comments regarding production.

"Ultimately, Pilbara [Minerals] is at the whim of the lithium price, but the business looks the best positioned to navigate this challenging period."

He reminded investors that lithium will still see heavy demand in the long run.

"While the pricing environment has softened for the time being, investors should not lose sight of the significant demand for lithium, with EV growth still high at around 30% this year."

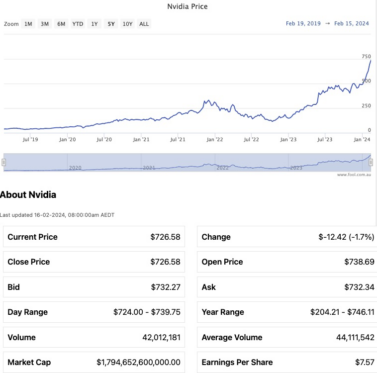

3. Nvidia earnings

On the other side of the Pacific, artificial intelligence (AI) darling Nvidia Corp (NASDAQ: NVDA) will report on Thursday morning Australian time.

Gilbert pointed out that the stock has now returned 1,500% to investors in the past five years.

"Last week, the artificial intelligence computing company claimed another feather in its cap, taking the title of the third largest company on the S&P 500 Index (SP: .INX).

"Within the last year, Jensen Huang and his team at Nvidia have grown its earnings by 500%, a remarkable feat that's even more remarkable given Wall Street expects that growth to continue."

Analyst consensus was that Nvidia would report earnings per share of US$4.56, said Gilbert, with a revenue of US$20.26 billion.

"If the last three results are anything to go by, we could even expect numbers much higher than that."

But more than the raw numbers, the market will be watching the outlook guidance, as the stock is priced highly for future success.

"Shareholders will want to hear that sales aren't slowing down and that the AI boom is not just a flash in the pan.

"With such outsized gains in less-than-optimal conditions, anything but perfect will put shares on the back foot."