ASX uranium shares have been all the rage of late due to a skyrocketing uranium commodity price.

The uranium price is up 110% over the past 12 months and trading at about US$106 per pound.

That's a 17-year high.

There is strong and rising global demand for uranium as countries embrace nuclear energy as part of the green energy transition.

Supply is currently restricted given so many uranium mines have been on care and maintenance while the uranium price was low.

This supply/demand imbalance is the key driver behind the stratospheric rise in the uranium price.

Fund manager Monash Investors is backing two particular ASX uranium shares for growth.

Which 2 ASX uranium shares does this fundie like most?

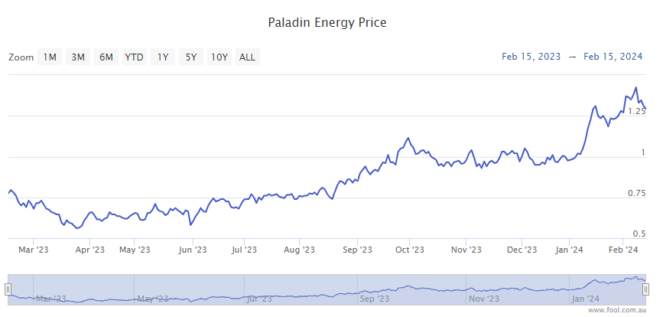

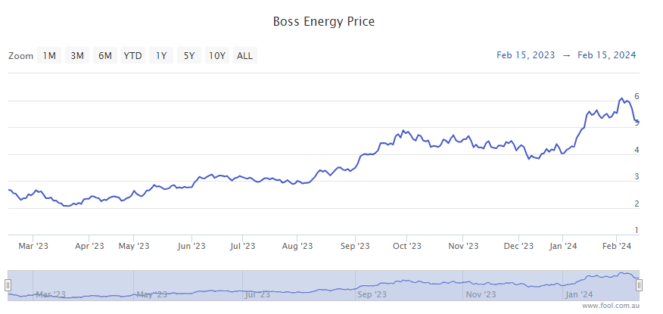

The fund manager's favourite stocks are Paladin Energy Ltd (ASX: PDN), which is the biggest uranium player by market capitalisation, and Boss Energy Ltd (ASX: BOE).

In the January update for the Monash Investors Small Companies Fund, the fundie said both were good contributors to an overall 0.3% increase (after fees) in the fund's value last month.

Monash describes both ASX uranium shares as "low-risk plays", commenting:

Both of these companies have large reserves in good jurisdictions, strong management expertise and are low-risk plays on the commodity.

The prospects for uranium supply and demand remain highly favourable.

The Paladin Energy share price is up 63% over the past 12 months.

The Boss Energy share price is up 108% over the past 12 months.

Another fundie, Shaw and Partners, is invested in five ASX uranium stocks, including Paladin Energy shares.

Last month the broker upped its 12-month forecast for the uranium price from US$85 per pound to US$150 per pound. It urged investors to buy uranium stocks now before "panic buying" sets in.