Investors in ASX lithium shares have had a headache for a year now as global prices for the battery ingredient have nosedived.

According to TradingEconomics, the lithium carbonate price was nearing 600000CNY per tonne 15 months ago but can now barely reach six figures.

And this has meant a classic cyclical downturn as is common in the mining industry.

ASX lithium stocks have plunged as some lithium mines have been forced to stop production because they had become uneconomical to keep running.

Like other minerals, most experts predict that the lithium price will eventually recover, especially with its importance in the transition to a lower carbon future.

But this environment has meant that only some lithium producers have had the financial resources to endure this tough part of the cycle.

So if you were to buy some lithium stocks right now while they're cheap, which ones are the best to go for?

A couple of fund managers had some ideas this week:

'Ability to remain profitable throughout the cycle'

Bell Potter advisor Christopher Watt has been impressed with Pilbara Minerals Ltd (ASX: PLS)'s resilience.

"The December 2023 quarterly activities update demonstrated Pilbara's ability to remain profitable throughout the cycle," Watt told The Bull.

He reckons Pilbara Minerals could absorb even more punishment.

"The lithium miner maintains a strong balance sheet to withstand any further declines in lithium prices.

"We expect the lithium market to recover in the long term and believe recent share price weakness in Pilbara presents a buying opportunity."

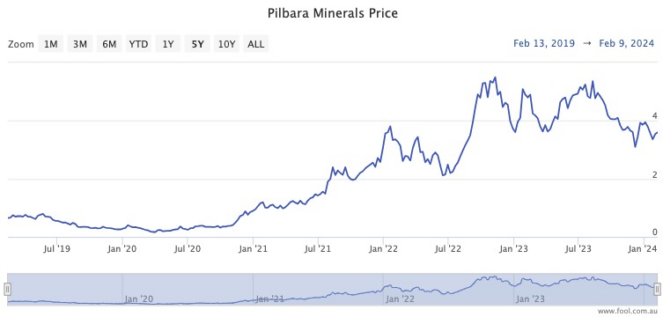

The Pilbara share price has lost about 26% over the past year, while paying out a fully franked 6.9% dividend yield.

Unfortunately, Pilbara shares are currently the most shorted stock on the ASX. However, this means that any revival could trigger a massive surge in price as short sellers seek to quickly cover their positions.

The lithium shares with a catalyst coming in June

Meanwhile, Baker Young analyst Toby Grimm's buy right now is Mineral Resources Ltd (ASX: MIN).

He admits the business is feeling the effects of low lithium prices, but one particular mine is providing much hope for the future.

"While still under pressure from falling lithium prices, we're encouraged by the company's recent update regarding the development of the Onslow iron ore project," he said.

"The project is on track to deliver [its] first ore-on-ship in June 2024."

And once this happens, it will deliver much needed funds to help it endure the tough conditions.

"It will provide excellent cash flow ahead of what we expect will be an eventual lithium market recovery."

MinRes shares have plunged 37% over the past 12 months. They are paying a 3.3% dividend yield, fully franked.