If you're willing to put up with a little bit more risk than the average, there are some ASX stocks out there with the capability to rocket in a short amount of time.

They potentially have some catalysts coming that, if they occur, could put an absolute rocket under the share price.

Of course, nothing is guaranteed, but enter these types of investments with an open mind and a risk-on mindset, and you may find yourself with handsome riches at the end of the journey.

Let's take a look at two ASX stock picks ripe with such potential:

Image source: Getty Images

Try a 1,400% gain for explosive potential

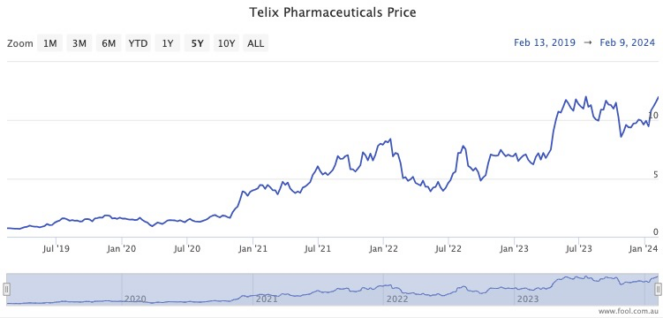

Telix Pharmaceuticals Ltd (ASX: TLX) shares, already up 15.8% so far this year, are a classic example of a growth stock with explosive capabilities.

It is a maker of anti-cancer diagnostic and therapeutic products.

This means that every success in the development process — clinical trials, regulatory approval, or commercial release — will be met with excitement in the stock market.

Its journey over the past few years is testament to that. The Telix share price has gained an unbelievable 1,468% in the past five years and 87% over the past 12 months.

The company is in a great position now because it already has a product, Illuccix, on sale commercially. So this brings in revenue to fund its future pipeline.

Many experts agree that Telix stocks have incredible potential. According to CMC Invest, all eight analysts studying the stock rate it as a buy.

The stock pick that could rocket with the economy

Chrysos Corporation Ltd (ASX: C79) has a very specific remit.

The company provides assay services for the mining industry, which means it tests samples to determine the quality and quantity of any minerals present.

Its PhotonAssay technology is unique in the industry for its speed, accuracy, and environmental credentials. And it is rapidly gaining customers.

That's shown in how the shares soared 77% over the past year, during a period in which the mining industry has had mixed fortunes.

So imagine how well the business and stock could do when the mining industry is in full swing in the coming years as the global economy recovers back to health.

The shares have dipped 16% this year, providing a buying opportunity.

Shaw and Partners senior investment advisor Jed Richards attributed that to Chrysos falling short of revenue expectations in a January update.

But that's a minor setback, as far as he's concerned.

"Delays in the number of PhotonAssay unit installations reflect timing issues as opposed to a reduction in demand," Richards told The Bull.

"We view the share price reaction as overdone, presenting attractive entry levels for investors."