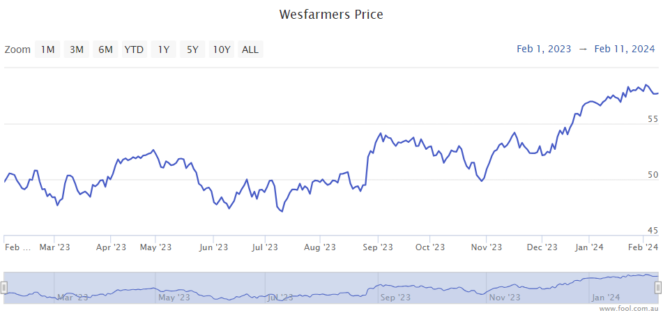

The Wesfarmers Ltd (ASX: WES) share price has been a solid performer in the last few months, despite challenging economic conditions. It's up more than 14% in the past six months.

The company is one of my blue-chip favourites. It usually offers an appealing mix of earnings growth and a decent dividend yield.

What does this business do?

Wesfarmers is the parent company of a number of different well-known brands including Bunnings, Kmart, Officeworks, Target, Catch and Priceline.

It has a chemicals, energy and fertilisers business called WesCEF, and it also owns a few other industrial businesses, including Blackwoods and Coregas.

The company recently made acquisitive moves in the healthcare sector with deals to buy Silk Laser Australia and Instantscripts. These were logical bolt-on acquisitions for the Australian Pharmaceutical Industries/healthcare division, which includes Priceline and Clear Skincare Clinics.

Are Wesfarmers shares a good long-term buy?

There are two main elements that make me believe it's a star ASX blue-chip stock.

First, the strength and diversification of its businesses are impressive to me.

Bunnings, Kmart and Officeworks are what I'd consider market leaders. And owning the best brands can come with a number of advantages, in my opinion.

A major strength of Wesfarmers is its ability and flexibility to buy different businesses in various industries. This allows it to find the best opportunities anywhere in the economy and apply its expertise and scale.

The other positive I want to point to is the company's impressive financials.

What I particularly like is the return on equity (ROE) and return on capital (ROC). It shows it's very profitable for the money it retains, and bodes well for medium-term growth (and Wesfarmers shares) if it can keep making those sorts of internal returns.

In FY23, Wesfarmers as a whole generated a ROE of 31.4%, which is a fantastic level of profitability. The company does pay attractive dividends, but I'd point out that it makes such good money on retained profit it would be vindicated to retain and invest more.

The company's biggest and most profitable divisions – Kmart and Bunnings – earn excellent returns. Bunnings reported a ROC of 65.4% in FY23, and Kmart Group reported a ROC of 47%.

To me, those numbers justify the business trading on the price/earnings (P/E) ratio that it does. According to Commsec, Wesfarmers shares are currently valued at 27x FY24's estimated earnings.