As reporting season continues in earnest, if you are invested in ASX shares you need to pay attention.

Fortunately for The Motley Fool readers, eToro market analyst Josh Gilbert has pointed out the three biggest events to monitor this week:

1. Australia unemployment

The financial markets, the Reserve Bank of Australia (RBA), and the general public will all be watching for the latest unemployment figures on Thursday.

Gilbert pointed out that December's rise to 3.9% exceeded expectations.

"December's uptick was perceived as a sign that the labour market could be loosening up, with job advertisement figures dipping and population growth remaining robust, suggesting that we might see a further rise in unemployment this week."

Similar to the rate hikes over 2022 and 2023, Gilbert reckons the RBA will again fall behind compared to its peers.

"It's likely to be one of the last major central banks to introduce rate cuts this year."

2. CSL half-year results

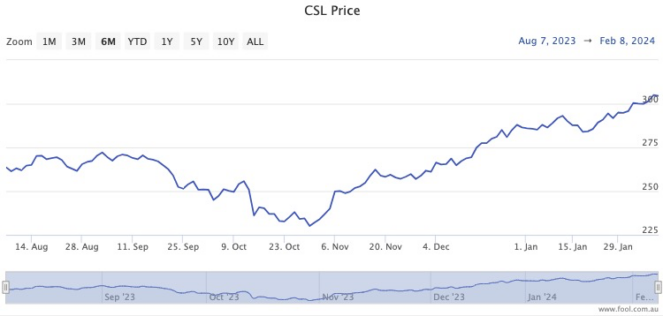

Biotech giant CSL Ltd (ASX: CSL) has enjoyed a 32% rise in its share price since late October.

But it recently saw a setback that could have longer term implications.

"The company's share price faced a decline [last week] following news of a UK investigation into alleged anti-competitive behaviour from CSL Vifor.

"If found guilty, CSL faces potential fines and reputational damage, which may impact the company's FY24 results."

The last reporting season was positive for the ASX healthcare company.

"Shareholders were pleased with the healthcare giant's FY23 results, where revenue growth went up 31% year-over-year to US$13.31 billion, and the company's FY24 guidance continued to hold firm."

On Tuesday morning, the market will be watching carefully how CSL is progressing in its underlying profit guidance of US$2.9 billion to US$3 billion for FY24.

"[Investors] are keen to ascertain whether CSL has sustained its course toward recovery following the turbulence its share price experienced in 2023."

3. Telstra half-year results

Another portfolio staple, Telstra Group Ltd (ASX: TLS) is reporting on Thursday.

According to Gilbert, the telco stock has been disappointing in recent times.

"It's been a lacklustre couple of years for Telstra, with shares falling by around 2% in that time, despite a 14% jump in profitability last year.

"This week's half-year results will be a key insight as to how cost-cutting has aided the businesses bottom line."

Gilbert is optimistic about the coming results, though.

"Telstra's profits look set to continue growing.

"In August, the business forecasted an EBITDA of $8.2 billion to $8.4 billion in FY24, well ahead of FY23's $7.86 billion."